How to Use Target Date Funds for Long-Term Investing

In an era where financial markets grow increasingly complex, individual investors seek simplified strategies to build wealth over time. Target date funds (TDFs), designed primarily for retirement planning, have gained popularity as an accessible, all-in-one investment solution. These funds adjust their asset allocation automatically as the investor approaches a specific “target date,” typically the year they plan to retire. Understanding how to leverage target date funds effectively for long-term investing is essential for maximizing their benefits and aligning them with one’s personal financial goals.

This article explores the fundamental concepts behind target date funds, offers practical guidance on their use for long-term investing, compares them to alternative options, and highlights future trends shaping their evolution. Backed by data and practical examples, readers will gain comprehensive insights into whether target date funds suit their long-term wealth-building strategies.

Understanding the Mechanics of Target Date Funds

Target date funds are mutual funds or exchange-traded funds (ETFs) that adjust their portfolio allocation based on a preset retirement or investment goal date. For instance, a “2050 target date fund” is tailored for investors planning to retire around the year 2050. The fund’s investment mix is designed to be more aggressive during the early years and increasingly conservative as the target date nears.

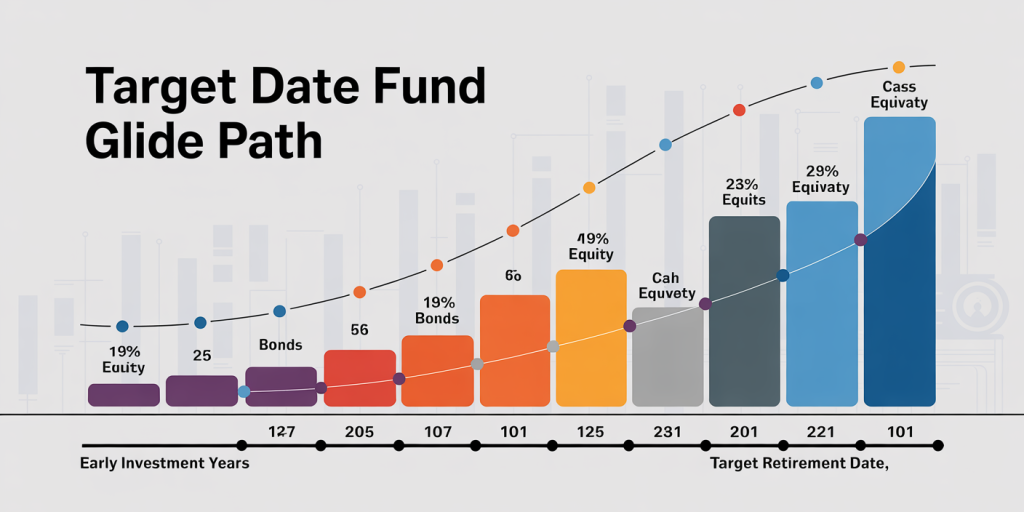

These funds begin by allocating a higher percentage of assets into risky investments such as stocks for growth potential, gradually shifting into more stable assets like bonds and cash equivalents to reduce volatility. This process, called the “glide path,” is the core feature that differentiates target date funds from traditional static asset allocations. For example, Vanguard’s Target Retirement 2050 Fund reduces its equity holdings from approximately 90% in the early stages to about 30% when the target date is reached, aiming to protect capital as the investor nears retirement.

While the glide path varies across fund providers, the key principle remains—balancing risk over time while simplifying investment decisions for the investor. According to the Investment Company Institute (ICI), target date funds represented nearly $2.1 trillion in U.S. retirement assets as of 2023, underscoring their growing importance in personal finance.

Selecting the Right Target Date Fund for Your Financial Goals

Choosing an appropriate target date fund involves more consideration than simply matching one’s expected retirement year. Investors should assess the fund’s glide path, fees, underlying asset allocations, and the fund manager’s track record.

For example, Fidelity Freedom 2050 Fund has an equity allocation that starts at about 85% and declines sharply to roughly 50% by the target date, making it relatively conservative compared to T. Rowe Price Retirement 2050 Fund, which retains a higher allocation to equities closer to the retirement year. These differences can impact both potential returns and volatility.

Investors in their 30s planning for retirement around 2050 might prefer a more aggressive glide path, emphasizing growth, while those seeking a more balanced risk approach may opt for a fund with a slower reduction in equity exposure. Additionally, fees play a significant role. According to Morningstar’s 2023 report, the average expense ratio for target date funds is around 0.45%, but it can range from as low as 0.12% (e.g., Vanguard Target Retirement Funds) to over 0.70% in some cases. Over decades, these fee differences significantly influence final investment balances.

Practical example: Consider two investors, both 30 years old in 2024, contributing $5,000 annually into target date funds aimed at retirement in 2050. Investor A picks a low-fee fund (0.12% expense ratio), while Investor B chooses one with a 0.70% fee. Assuming an average annual return of 7%, by 2050, Investor A’s portfolio would be roughly 15% larger than Investor B’s, demonstrating the power of cost in long-term investing.

Advantages and Limitations of Target Date Funds for Long-Term Investing

Target date funds offer several advantages for long-term investors, especially those who prefer a hands-off approach. First, they provide professional management with automatic asset allocation adjustments based on age or retirement timeline. This reduces the need for continuous portfolio rebalancing and helps avoid emotional investment decisions during market volatility.

Moreover, target date funds promote diversification across asset classes, sectors, and geographic regions, mitigating risks inherent in concentrated portfolios. According to a study by Morningstar in 2022, target date funds generally hold a diversified mix of U.S. large-cap stocks (approx. 40-50%), international stocks (20-30%), fixed income (20-40%), and alternative assets (5-10%), depending on the fund’s glide path and maturity.

However, investors should also understand the limitations. Glide paths are standardized, meaning the asset allocation might not perfectly align with individual risk tolerances or financial circumstances. For example, an aggressive glide path might expose risk-averse investors to volatility levels they find uncomfortable, leading to premature withdrawals or reduced contributions.

Additionally, target date funds may not account for other income sources or portfolios, potentially leading to over- or under-exposure to certain asset classes. Another drawback is the lack of customization; investors cannot fine-tune holdings within a target date fund, locking them into the fund’s chosen investment philosophy and security selection.

How to Integrate Target Date Funds into a Larger Investment Strategy

Long-term investors can effectively incorporate target date funds as a core component of their portfolios, complementing other investments such as individual stocks, bonds, real estate, or alternative assets. For many, especially retirees or nearing-retirement individuals, a target date fund can function as the central “set-it-and-forget-it” element providing a balanced risk-return profile.

Consider a young professional who also holds company stock options or personal real estate investments. Using a target date fund as the baseline portfolio can simplify management while enabling the individual to take tactical positions elsewhere. For example, an investor might allocate 70% of retirement savings to a target date fund, 20% to diversified individual equity holdings, and 10% to bonds to tailor risk more precisely.

Table: Sample Portfolio Allocation Including a Target Date Fund

| Investment Type | Allocation (%) | Purpose | Notes |

|---|---|---|---|

| Target Date Fund (2050) | 70 | Core growth and risk management | Automatically adjusts risk over time |

| Individual Stocks | 15 | Enhanced growth | Active selection can outperform or underperform |

| Bonds | 10 | Income and stability | Complements glide path risk reduction |

| Real Estate Investment Trusts (REITs) | 5 | Diversification and inflation hedge | Provides alternative asset exposure |

This approach blends the convenience and professional management of the target date fund with customization opportunities. Periodic reviews, perhaps annually, will ensure allocations remain aligned with evolving financial goals.

Case Study: Impact of Target Date Fund Performance During Market Cycles

Understanding how target date funds perform during different market cycles is crucial for long-term investors. During the 2008 financial crisis, many target date funds saw sharp value declines due to heavy equity exposure early in the glide path. For instance, the Vanguard Target Retirement 2040 Fund, with approximately 90% equities at the time, declined over 30%.

However, by gradually shifting toward less volatile bonds and cash equivalents as the target date approached, these funds mitigated losses for investors closer to retirement. More recently, the market volatility caused by the COVID-19 pandemic in early 2020 saw a swift recovery in target date funds, led by U.S. stock rebounds.

Investors like Jane Doe, who started investing in a 2050 target date fund in 2010 at age 30, experienced fluctuations but benefited from the fund’s automatic rebalancing. Her patience and systematic investment during downturns led to substantial portfolio growth—an illustration of TDFs’ potential to smooth market risks over full investment horizons. According to a Vanguard report, investors who remained invested in TDFs throughout the 2008-09 crisis recovered gains within five years.

Future Perspectives: Innovations and Trends in Target Date Funds

Target date funds continue to evolve, incorporating technological advances, expanded asset class exposure, and improved personalization. One emerging trend is the integration of environmental, social, and governance (ESG) factors into target date funds. For example, BlackRock now offers ESG-focused target date funds, appealing to investors interested in sustainable investing.

Another development is the use of artificial intelligence and data analytics to optimize glide paths more dynamically. Instead of a fixed static glide path, some providers explore adaptive models responding to real-time economic conditions, inflation rates, and market volatility to adjust allocations more intuitively.

Moreover, the inclusion of alternative assets like private equity, infrastructure, and real assets is becoming more common in TDF portfolios to enhance diversification and reduce correlation with traditional stocks and bonds.

Furthermore, regulatory discussions and investor demand could drive more customizable target date solutions, possibly incorporating modular approaches, allowing individuals to personalize risk levels without losing the funds’ automatic adjustment benefits.

In terms of market impact, the increasing popularity of target date funds means they will significantly influence capital flows in public markets. According to Cerulli Associates, TDF assets under management are expected to exceed $3 trillion by 2027 in the U.S. alone, underscoring their growing role in retirement and long-term investing ecosystems.

Using target date funds for long-term investing offers a blend of simplicity and strategic risk management, making them with increasing appeal across demographic groups. By understanding how to select, integrate, and adapt their use within broader portfolios, investors can harness their potential while navigating limitations. As innovations continue and investors’ needs evolve, target date funds stand poised to remain a key pillar in disciplined wealth accumulation strategies.