How to Use Alternative Investments to Diversify Your Portfolio

In the ever-changing financial landscape, the pursuit of a well-diversified investment portfolio remains a crucial goal for investors, whether novice or seasoned. Traditional assets such as stocks, bonds, and cash equivalents have long dominated portfolios, but relying solely on these can expose investors to significant market volatility and sector-specific risks. Alternative investments have emerged as powerful tools to enhance portfolio diversification, reduce correlation to traditional markets, and potentially improve risk-adjusted returns.

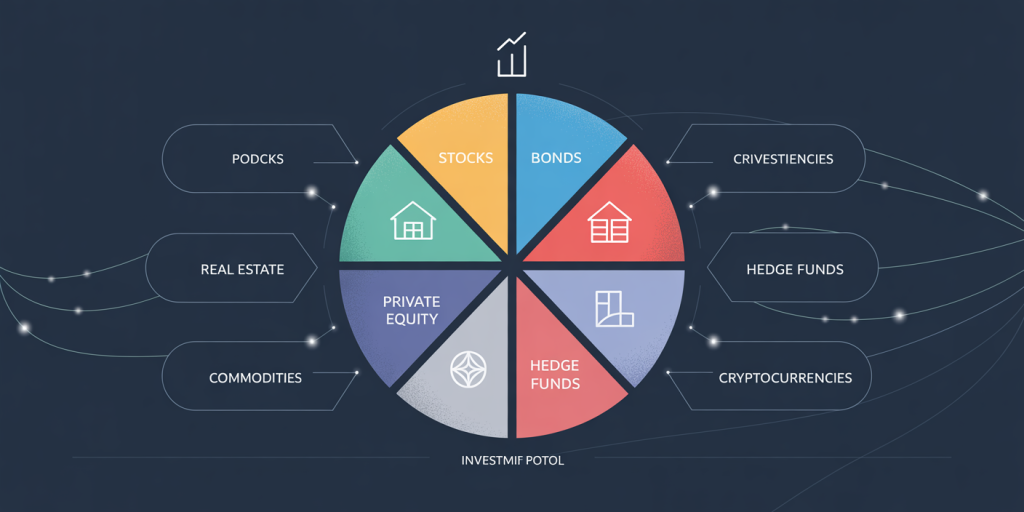

Alternative assets refer to investments outside the conventional equity and fixed income markets. They encompass a broad range of vehicles including real estate, private equity, hedge funds, commodities, infrastructure, collectibles, and cryptocurrencies. Incorporating such alternatives requires a strategic approach rooted in understanding their unique characteristics, historical performance, and the roles they can play in your portfolio.

Understanding Alternative Investments and Their Role in Diversification

Alternative investments typically exhibit lower correlation with traditional stocks and bonds, meaning their price movements often do not align with conventional market trends. This phenomenon is essential for diversification as it smoothens the overall portfolio returns during turbulent market phases. For example, during the 2008 financial crisis, many hedge funds and certain real estate investments showed resilience or even positive returns while the stock market plummeted.

Moreover, alternative investments often come with different risk-return profiles, liquidity characteristics, and investment horizons, which can help balance risk within a portfolio. Private equity, for instance, generally involves longer lock-up periods but can deliver outsized gains. Conversely, commodities may offer inflation protection and act as a hedge against currency devaluation.

Statistical studies underscore the benefits of including alternatives: a 2022 report by Preqin revealed that portfolios with 15-25% alternative investments historically outperformed traditional-only portfolios by 2-3% annually on a risk-adjusted basis over the past decade. This highlights their potential to enhance portfolio efficiency.

Key Categories of Alternative Investments

Real Estate

Real estate is one of the most accessible alternative asset classes available to individual investors, typically via Real Estate Investment Trusts (REITs), private real estate funds, or direct property ownership. Properties tend to generate steady income streams through rents and possess intrinsic value, making them attractive for capital preservation alongside growth.

A practical example is the surge in industrial REITs during the COVID-19 pandemic, driven by massive growth in e-commerce and logistics demand. Prologis, a leading industrial REIT, returned approximately 36% in 2021, outperforming many traditional stocks.

Private Equity and Venture Capital

Private equity involves investing in privately-held companies or buying out public firms to restructure and enhance value before exiting via IPOs or sales. Venture capital is a subset focused on startup and early-stage companies with high growth potential but also higher risk.

Consider the famous case of Sequoia Capital investing early in companies like Airbnb and Google, allowing investors to reap disproportionate returns unavailable in public markets. According to McKinsey’s 2023 Private Markets Review, private equity delivered a 14% net internal rate of return (IRR) over the last 10 years, compared to 10% for public equities.

Hedge Funds

Hedge funds employ diverse strategies—long/short equity, global macro, event-driven, among others—to generate alpha irrespective of market direction. Their flexibility, leverage use, and risk management techniques provide unique return streams. For example, during the 2020 market crash, some global macro hedge funds posted gains of 10-15%, capitalizing on volatility and economic shifts.

However, hedge funds often come with high fees (2% management and 20% performance fee) and require significant minimum investments, so due diligence is critical.

Commodities and Natural Resources

Commodities such as gold, oil, agricultural products, and metals have historically offered a hedge against inflation and currency depreciation. Gold, for example, is a recognized safe haven during periods of geopolitical uncertainty.

The 2008 crisis and more recent inflationary environments saw gold prices rise sharply, providing downside protection. An investor holding 10% in gold through ETFs like SPDR Gold Shares (GLD) would have reduced portfolio drawdowns during these periods.

| Alternative Asset | Expected Annual Return (10-Year Avg) | Correlation to S&P 500 | Liquidity | Typical Investment Horizon |

|---|---|---|---|---|

| Real Estate (REITs) | 8-12% | 0.5 | Moderate | 3-7 years |

| Private Equity | 12-15% | 0.3 | Low (illiquid) | 7-10 years |

| Hedge Funds | 8-10% | 0.4 | Low to Moderate | 1-5 years |

| Commodities | 5-9% | 0.2 | High (via ETFs) | Short to medium term |

Practical Steps to Incorporate Alternative Investments

Evaluate Your Risk Tolerance and Investment Goals

Before adding alternatives, understand your risk profile and time horizon. For instance, if you have a low liquidity tolerance, private equity or direct real estate investment with long lock-up periods may not be suitable. Instead, you may consider liquid alternatives like commodity ETFs or publicly traded REITs.

An investor nearing retirement might allocate 10% to alternatives focused on income generation (real estate, infrastructure) while a younger investor with a longer horizon might allocate 20-25% towards growth-focused private equity and venture capital.

Utilize Exchange-Traded Funds (ETFs) and Mutual Funds

For many retail investors, direct access to alternatives is challenging due to high minimum investments or illiquidity. Hence, ETFs and mutual funds provide an efficient gateway. For example, funds like the iShares Global REIT ETF (REET) or the Invesco DB Commodity Index Tracking Fund (DBC) offer exposure to real estate and commodities at relatively low cost and with liquidity akin to stocks.

Diversify Within Alternatives

Just as diversification within stocks and bonds reduces risk, spreading investments across various alternative asset classes is essential. Combining real estate, commodities, and hedge fund strategies can optimize diversification benefits. For example, during the volatile 2020 market period, while commodities rallied with inflation fears, real estate suffered early but recovered later, and hedge funds captured multiple trends.

Real-life case: Yale University’s endowment fund, managed by David Swensen, is renowned for its allocation to alternatives—over 70% invested in private equity, real estate, and hedge funds—helping achieve average returns exceeding 12% annually for decades.

Monitor Fees and Tax Implications

Alternative investments often entail higher fees involved in fund management, performance incentives, transaction costs, and tax considerations, particularly with private equity and hedge funds. Higher fees can erode net returns significantly over time.

Tax strategies like investing via tax-deferred accounts (IRAs, 401(k)s) for alternatives where possible, or understanding capital gains treatment on collectibles and real estate gains, can optimize after-tax returns.

Case Studies Demonstrating Alternative Investment Success

The Harvard Endowment Model

Harvard University’s endowment fund is a classic example of successful alternative investment allocation. As of 2023, Harvard’s portfolio comprises approximately 54% in alternatives, with a sizable portion in private equity and real estate. Over the past 30 years, this strategy yielded an average annual return of 11.3%, outperforming broad equity benchmarks.

The diversified alternative portfolio lessened dependence on stock market cycles and allowed for exposure to high-growth private markets and tangible assets.

Individual Investor Incorporating Alternatives

Jane, a 40-year-old professional, rebalanced her portfolio by allocating 20% to alternatives: 8% to REITs, 7% to commodity ETFs, and 5% to a diversified hedge fund mutual fund. Over three years, despite a volatile stock market, her portfolio volatility decreased by 15%, while annual returns increased by 1.8% compared to a traditional 60/40 equity-bond mix.

This practical example illustrates how alternatives improve portfolio stability and enhance returns when used judiciously.

Risks and Challenges Associated with Alternative Investments

While alternatives provide diversification and potential enhanced returns, they are not devoid of risks. Illiquidity is a major concern; private equity funds usually have lock-ups lasting 7-10 years, limiting investor flexibility. Valuation transparency can be an issue—assets like real estate and private companies are not priced daily like stocks, leading to less frequent marks and potential valuation adjustments.

Moreover, regulatory and operational risks can affect hedge funds and venture capital investments. For instance, the failure of certain hedge funds during the 2007-2008 crisis was tied to leverage and liquidity mismatches.

A crucial example is the hedge fund Long-Term Capital Management (LTCM) collapse in 1998, caused by excessive leverage and correlated risks that triggered systemic effects on global markets.

Therefore, investors must perform thorough due diligence, understand the risk-return tradeoff, and consider how alternatives fit within the broader portfolio strategy.

Looking Ahead: The Future of Alternative Investments

As global markets evolve, alternative investments are primed to play an increasingly important role in portfolio diversification. Technological advances like blockchain have democratized access to traditionally exclusive investments via fractional ownership and tokenization. This could lower minimum investment thresholds for private equity and real estate, enhancing liquidity and transparency.

Environmental, Social, and Governance (ESG) considerations are also reshaping alternatives. Impact investing within private equity and infrastructure is attracting growing investor interest, aligning financial goals with sustainability.

Data from Preqin’s 2024 outlook projects that alternative assets under management will exceed $18 trillion by 2030, reflecting a compound annual growth rate of nearly 10%. The rising availability of alternative investment vehicles tailored for retail investors, alongside improving regulatory frameworks, is expected to facilitate broader adoption.

Furthermore, artificial intelligence and big data analytics are transforming asset selection and risk management across all investment types, including alternatives, potentially increasing their effectiveness and appeal.

In summary, integrating alternative investments thoughtfully can significantly enhance portfolio resilience and return potential. By staying informed about evolving trends, leveraging technology, and applying disciplined investment principles, investors can harness the power of alternatives to achieve diverse and robust portfolios that withstand market uncertainties.