Building Wealth with Monthly Investing: The Psychology of Consistency

Accumulating wealth over time is a goal shared by many, but achieving it requires more than just having sufficient capital—it demands a disciplined approach that aligns with psychological principles. Monthly investing stands out as a powerful strategy to grow wealth gradually, leveraging the power of compounding while mitigating market volatility. This article delves deep into the psychology behind consistent investing and explores practical methods to harness this strategy for long-term financial success.

A conceptual illustration showing the psychology of consistent monthly investing: a calm investor placing equal monthly investment coins into a growing plant symbolizing wealth, with a background of fluctuating market graphs to represent volatility reduction and emotional control.

Understanding the Power of Consistency in Investing

Consistency plays a pivotal role in wealth creation. While large lump-sum investments can yield significant returns, they also expose investors to market timing risks. Monthly investing, by contrast, offers a systematic approach, allowing investors to spread out their investments over time. This strategy not only reduces the psychological burden of timing the market right but also builds a habit of saving and investing regularly.

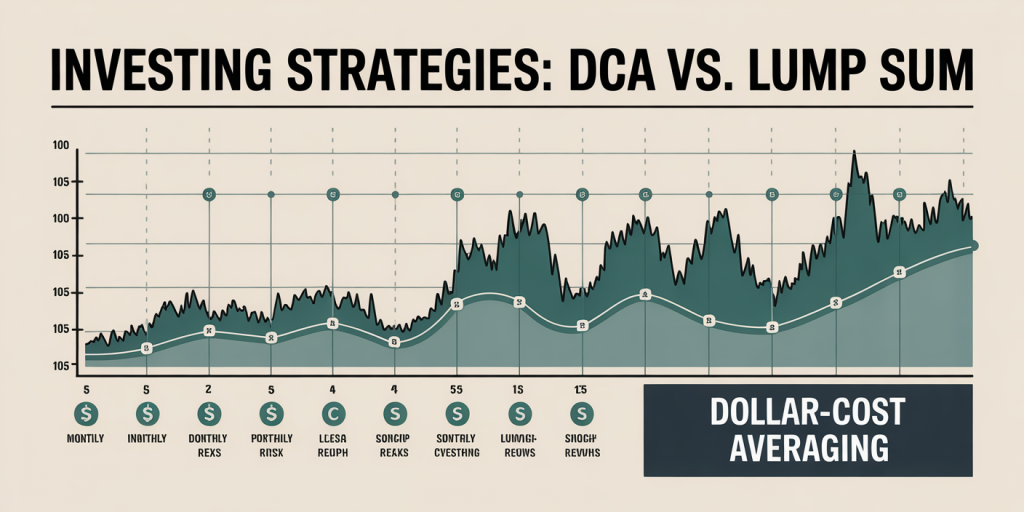

An informative infographic-style image comparing dollar-cost averaging (monthly investing) versus lump-sum investing, featuring a side-by-side visual of investment timelines, fluctuating market prices, risk exposure, and portfolio growth over 10 years, highlighting lower risk and steadier returns of monthly investing.

For example, consider an investor who commits to investing $500 monthly in an index fund rather than attempting to invest a lump sum of $6,000 at once. Over time, the investor buys shares at varying prices, effectively benefiting from dollar-cost averaging. This simple concept helps minimize the effects of market volatility and reduces emotional decision-making—a common pitfall during market fluctuations.

Research supports this approach: according to a 2023 Vanguard study, investors who adopted systematic monthly contributions had a 35% higher likelihood of achieving their financial goals compared to those who attempted sporadic investing or lump-sum investments during market highs. Thus, consistency helps smooth returns and cultivate disciplined financial behavior.

The Psychological Barriers to Investing and How Consistency Helps

Many aspiring investors struggle not due to lack of funds but because of psychological barriers such as fear, procrastination, and overanalyzing market conditions. Fear of loss, for instance, often leads individuals to exit markets prematurely or delay investing altogether. However, monthly investing counteracts such tendencies by emphasizing small, manageable contributions instead of intimidating lump sums.

A practical case is the story of Sarah, a 30-year-old professional who initially hesitated to invest during market dips. By setting up an automated monthly investment plan of $300 into a diversified mutual fund, Sarah overcame her anxiety. Over five years, this consistency allowed her portfolio to grow by 45%, demonstrating how small, regular actions can overpower emotional responses.

Procrastination is another significant barrier. The tendency to “wait for the right time” often results in delayed investing, missing out on compound growth. With monthly investing, the focus shifts from timing to creating a regular habit. Automated transfers to investment accounts reduce the likelihood of procrastination, ensuring steady progress toward financial goals.

Dollar-Cost Averaging: Minimizing Risk While Maximizing Gains

Dollar-cost averaging (DCA) is a cornerstone concept tied closely to monthly investing. It involves investing a fixed sum at regular intervals regardless of market conditions. This approach reduces the risk of investing a lump sum at an inopportune time, such as right before a market downturn.

To illustrate, consider this comparative table highlighting the impact of DCA versus lump-sum investing over a decade (2013–2023) in the S&P 500:

| Investment Strategy | Total Invested | Final Portfolio Value | Annualized Return | Risk Exposure |

|---|---|---|---|---|

| Lump-Sum Investing | $60,000 | $124,500 | 7.6% | Higher (single entry) |

| Monthly Investing (DCA) | $60,000 | $120,300 | 7.2% | Lower (spread risk) |

Source: Historical S&P 500 Data, 2013-2023

While lump-sum investing slightly outperformed in terms of returns, it carries a higher risk if invested just before a downturn. Monthly investing offers peace of mind by averaging purchase costs and reducing exposure to market timing. Psychological comfort gained through DCA can be invaluable for maintaining investment discipline during volatile periods.

Moreover, the consistency of monthly investing aligns well with the behavioral finance principle of “loss aversion,” where individuals prefer to avoid losses more than they seek equivalent gains. By smoothing out purchase price variability, investors experience fewer severe emotional swings, fostering longer-term commitment.

Building a Monthly Investing Plan: Practical Steps and Tools

Establishing a monthly investing plan requires careful consideration of financial goals, risk tolerance, and available capital. The first practical step is setting clear, measurable objectives—whether these entail retirement savings, a down payment on a home, or funding education expenses.

Tax-advantaged accounts such as 401(k)s, IRAs, or Roth IRAs are excellent vehicles for monthly investing, offering benefits like tax deferral or tax-free growth. For instance, contributing $500 monthly to a Roth IRA starting at age 25 could result in approximately $700,000 by age 65, assuming an average annual return of 7%.

To automate consistency, many financial institutions offer scheduled investment options. For example, platforms like Vanguard, Fidelity, or Betterment allow users to set up recurring monthly purchases of mutual funds or ETFs. Automation removes the friction of manually initiating transactions, which helps maintain steady investing habits.

Practical budgeting also plays an essential role. Allocating a fixed percentage of monthly income toward investing—typically 10-20%, depending on personal circumstances—can help balance day-to-day expenses and future wealth generation. Creating an emergency fund before investing is advisable to avoid premature withdrawals that disrupt compounded growth.

In addition, investors should periodically review and rebalance portfolios, ideally once or twice annually. Adapting asset allocations ensures the investment strategy remains aligned with evolving risk tolerance and market conditions.

Real Cases of Consistency Paying Off: Lessons from Long-Term Investors

Examining real-world examples provides insights into the tangible benefits of monthly investing. One notable case is Warren Buffett, who advocates for regular investment in low-cost index funds for most investors. Buffett’s philosophy emphasizes that time in the market, not timing the market, generates wealth—an endorsement of consistency.

Another example is a study conducted by Charles Schwab in 2020, which tracked 500 investors over 20 years who contributed monthly to diversified portfolios. The average investor saw a portfolio growth of 8.5% per annum, far outpacing inflation and bank savings accounts. Notably, investor retention rates were highest among those with automated monthly contributions, highlighting behavioral advantages.

Michael, a middle-income earner from Texas, shared his experience of starting monthly investments in his early 30s with $200 per month. Over 25 years, his portfolio grew to over $250,000, sufficient to fund a comfortable early retirement. Michael credits his success to automated investing and resisting market temptations to withdraw funds during downturns.

Table 2 below contrasts hypothetical portfolio balances with and without monthly investing over 25 years at 7% annualized returns.

| Year | Monthly Investing ($200/month) | No New Investments (Initial Lump Sum $0) |

|---|---|---|

| 5 | $13,438 | $0 |

| 10 | $31,068 | $0 |

| 15 | $54,876 | $0 |

| 20 | $88,248 | $0 |

| 25 | $133,321 | $0 |

Source: Compound Interest Calculator

This contrast underlines the critical importance of regular contributions building wealth gradually, as opposed to relying solely on lump-sum amounts or occasional investments.

The Future of Monthly Investing: Technology and Behavioral Advancements

Looking ahead, monthly investing is set to become increasingly accessible and efficient thanks to technological and behavioral innovations. Robo-advisors, for instance, have democratized investment management by providing automated portfolio allocations tailored to individual profiles. These platforms facilitate monthly contributions, rebalancing, and tax-loss harvesting with minimal manual input.

According to a 2023 report by Statista, robo-advisor assets under management grew to over $1.4 trillion globally, with a significant portion of users leveraging monthly investing features. This shift heralds a future where even novice investors can harness consistent investing strategies with ease.

Behavioral science is also influencing investment platforms, incorporating nudges and reminders to enhance investor consistency. Gamification techniques, personalized data visualization, and community-driven challenges encourage users to stick to their monthly plans. For example, apps like Acorns and Stash integrate round-up investing and goal tracking, making saving and investing more engaging and routine.

A futuristic scene depicting technology-enabled monthly investing: a user interacting with a smartphone app showing automated investment schedules, robo-advisor algorithms, gamified progress tracking, and community engagement icons, symbolizing behavioral finance tools improving investor consistency and long-term wealth building.

Furthermore, evolving economic landscapes, including rising inflation and changing retirement norms, underscore the need for resilient, consistent investing habits. Monthly investing aligns well with adapting to these trends, offering investors a scalable method to build financial security progressively.

Financial education initiatives globally are increasingly emphasizing the psychology of investing consistency, with governments and private organizations collaborating to equip individuals with tools to overcome behavioral biases and implement disciplined saving.

Final Thoughts: Empowering Wealth through Consistency

Building wealth is rarely about overnight success; instead, it’s a marathon requiring steady steps fueled by psychological resilience and smart strategies. Monthly investing embodies this philosophy by combining financial prudence with behavioral insights that encourage consistency, reduce stress, and allow compounding to work its magic.

Investors who understand and harness the power of psychological consistency—while utilizing practical tools like automation, dollar-cost averaging, and diversified portfolios—position themselves to realize substantial financial growth over time. As technology and behavioral science evolve, monthly investing will continue to be a cornerstone strategy for aspiring wealth builders in an increasingly complex financial world.

Embracing the psychology of consistency doesn’t just grow portfolios; it fosters confidence and empowerment, transforming investing from a source of anxiety into a pathway toward financial freedom and peace of mind.