How to Read a Fund Prospectus Without Falling Asleep

Navigating the investment world can be intimidating, especially when confronted with dense legal documents like fund prospectuses. These documents are essential tools for investors, containing critical information about investment objectives, risks, fees, and management details. However, their complex language and extensive length often cause readers to lose focus or give up altogether. Understanding how to effectively read a fund prospectus is crucial to making informed investment choices. This article offers practical tips, insights, and comparative analysis to help you engage with fund prospectuses actively, avoid boredom, and enhance your investment decision-making process.

Why Fund Prospectuses Matter More Than You Think

Fund prospectuses serve as the backbone of transparency and investor protection in the investment market. Produced primarily by mutual funds, exchange-traded funds (ETFs), and other pooled investment vehicles, these documents disclose how the fund operates, its investment philosophy, fee structures, and risks. According to the Investment Company Institute, approximately $24.8 trillion was invested in U.S. mutual funds alone as of 2023, emphasizing the enormous scale and importance of understanding these documents.

Ignoring a fund prospectus or skimming through it recklessly may lead to uninformed decisions, increased exposure to unexpected risks, and unnecessary fees. For example, in 2017, the SEC fined a fund for failing to disclose certain fees accurately in its prospectus, which had misled investors about the true cost of their investment. This case illustrates how transparency and due diligence can affect both investor confidence and regulatory compliance.

Clearly, reading a fund prospectus isn’t optional; it’s an essential step to ensure your investment aligns with your financial goals and risk tolerance. The challenge lies in maintaining focus and extracting meaningful information without succumbing to fatigue or boredom.

Start With The Big Picture: Focus on Key Sections First

Most fund prospectuses are structured in standardized formats consisting of several core sections, including the fund’s investment objectives, fee schedules, risk factors, and management details. Trying to read every page in sequence can be overwhelming and tedious, so a tactical approach is to prioritize the most critical components first.

A detailed, visually engaging infographic illustrating the key sections of a fund prospectus, including investment objectives, fee structures, risk factors, and management details, with icons and clear labels to simplify complex financial information.

Begin by examining the Fund Summary or Highlights section, often placed near the front. It provides a concise overview of the fund’s objectives, primary holdings, performance history, and costs. For instance, the Vanguard 500 Index Fund prospectus simplifies the inclusion of broad stock market exposure with low fees—a key attraction for passive investors. This early snapshot helps you determine if a deeper dive is worthwhile.

Next, focus on the Fee Structure section closely. Fees have a direct impact on long-term returns. A comparative example helps clarify this:

| Fee Type | Typical Range | Impact on $10,000 Investment Over 10 Years* |

|---|---|---|

| Expense Ratio | 0.05% to 1.5% | Reduces returns by $500 to $1,500 |

| Front-End Load | 0% to 5.75% | Reduces initial investment by up to $575 |

| 12b-1 Fees | 0% to 1% | Annual marketing fees increasing costs |

*Assuming a 7% average return before fees.

By focusing on these sections first, investors can rapidly screen funds based on alignment with their goals and cost sensitivity, optimizing time and energy spent reading.

Practical Techniques to Maintain Focus and Comprehension

Reading a prospectus need not be a monotonous task if you apply techniques to stay engaged and improve comprehension. Using strategies catered to your learning style can significantly reduce the boredom barrier.

One such method is to summarize and annotate as you go. For example, while reading the risk factors, jot down the specific risks that resonate with your personal risk tolerance—like market volatility, interest rate risk, or credit risk. Highlighting phrases such as “the fund may experience losses” transforms passive reading into active evaluation.

Another technique is to break the prospectus into manageable sessions, setting specific goals (e.g., understanding the fees today, reviewing management details tomorrow). This approach reduces cognitive overload and allows time to process complex concepts incrementally. For instance, the 2022 BlackRock Equity Income Fund prospectus runs over 40 pages—trying to read it all in one sitting can exhaust even the most motivated individuals.

Utilizing available tools and resources can also support your journey. Websites like Morningstar and the SEC’s EDGAR database often provide summarized fund reports, performance data, and raw filings. Watching short video explainers or listening to podcasts about fund structures can reinforce understanding through multimedia approaches, appealing to different senses and learning preferences.

Decoding Complex Jargon: Making Sense of Legal and Financial Terms

Fund prospectuses tend to be laden with technical jargon and legalese, which can discourage many readers. Familiarizing yourself with common terms and learning how to decode them is critical to maintaining interest and comprehension.

For example, terms like “net asset value (NAV),” “bid-ask spread,” “prospective risk,” or “redemption fees” can cause confusion without context. Creating a personal glossary or referring to websites such as Investopedia can be invaluable. Let’s clarify a few: Net Asset Value (NAV): The price per share of the fund, calculated by dividing the total value of assets minus liabilities by the number of shares outstanding. Expense Ratio: The annual fee charged by the fund manager for operating the fund. Front-End Load: A sales charge paid when purchasing shares of a fund. Turnover Rate: Percentage of fund assets bought and sold during a year, indicating portfolio activity level.

By decoding these terms, you transform the prospectus from an opaque legal document into an actionable roadmap guiding informed decisions. For example, understanding that a high turnover rate often correlates with higher transaction costs helps investors avoid expensive funds.

Comparing Fund Prospectuses: Why Context and Alternatives Matter

Reading a single fund prospectus in isolation limits your ability to contextualize its features or identify the best fit for your portfolio. Comparing several prospectuses side-by-side is a proven way to engage more thoroughly and recognize strengths and weaknesses in each offering.

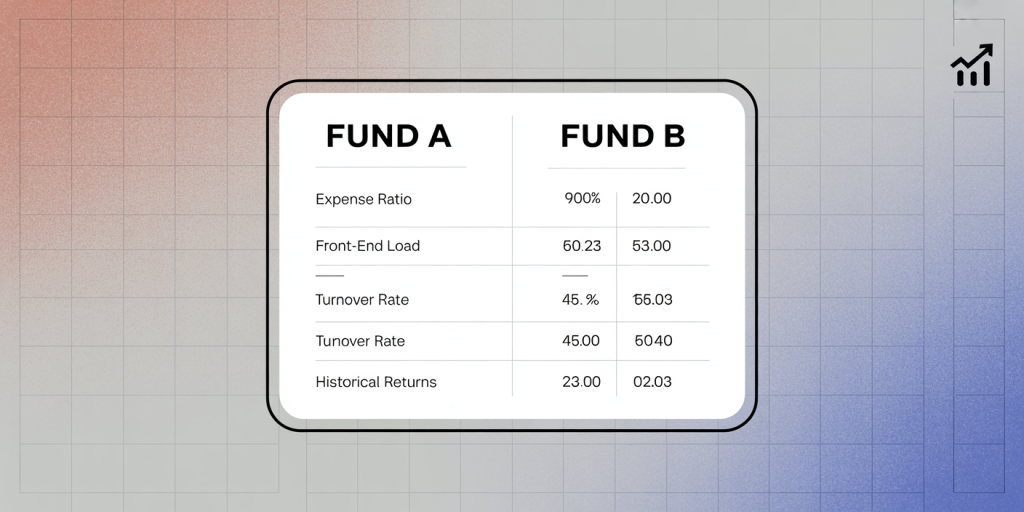

Consider this simplified table comparing two hypothetical mutual funds, Fund A and Fund B:

| Attribute | Fund A | Fund B |

|---|---|---|

| Investment Objective | Growth-oriented large cap | Balanced growth and income |

| Expense Ratio | 0.85% | 1.20% |

| Historical 5-Year Return | 8.5% | 7.0% |

| Front-End Load | None | 4.5% |

| Turnover Rate | 15% | 40% |

| Dividend Yield | 1.2% | 2.5% |

With this comparison, you immediately note that Fund A offers a lower expense ratio and no front-end load but a more focused equity approach, while Fund B has higher fees, greater portfolio turnover, and a higher yield targeting income investors. This method promotes critical thinking about how fees, objectives, and performance align with your investment goals.

A comparative table-style image showing side-by-side features of two hypothetical mutual funds (Fund A and Fund B), highlighting differences in expense ratios, front-end loads, turnover rates, and historical returns, designed with clean, professional aesthetics for easy investor understanding.

A famous case is the long-standing battle between index funds and actively managed funds. Numerous prospectus comparisons reveal that index funds tend to have lower fees, lower turnover, and competitive returns in the long term—leading to the popularity of passive investing strategies among retail investors.

Understanding Performance Data: What Numbers to Trust and How

Performance data, often located in the fund summary or performance sections, attract most investors’ attention. While past performance isn’t a guarantee of future results, comprehending these statistics is vital, especially in avoiding common traps and misinterpretations.

Funds often include annualized returns, benchmarks, and risk measures such as standard deviation and beta. For instance, a prospectus may show that the fund’s five-year annualized return was 7%, compared to its benchmark’s 6.5%. But the prospectus also clarifies the fund had a 15% standard deviation, indicating higher volatility than the market. Investors must balance returns with associated risk levels rather than chase the highest returns alone.

Beware of cherry-picked data focusing on the best-performing years. A fund’s prospectus sometimes includes long-term performance tables with returns over 1, 5, and 10 years. It’s best to look at those spanning multiple market cycles to get a fuller picture.

In a real-world example, the Fidelity Magellan Fund had stellar returns in the 1980s and ‘90s but underperformed in the early 2000s. Investors relying solely on short-term excerpts in the prospectus without reviewing historical context might make suboptimal decisions.

Investing With Confidence: Future Perspectives on Fund Prospectuses

The future of fund prospectuses appears poised for evolution, driven by regulatory reforms, technology advancements, and evolving investor demands. Regulators such as the U.S. Securities and Exchange Commission (SEC) are pushing for more concise, plain-language disclosures to enhance readability and accessibility. In 2022, the SEC proposed new rules encouraging funds to produce summary prospectuses that are no more than four pages, dramatically improving digestibility.

A modern, tech-inspired scene depicting an investor using AI-powered tools on a laptop and tablet to analyze and summarize a fund prospectus, surrounded by elements representing regulatory reforms, ESG investing icons, and simplified plain-language documents.

Technological tools are also revolutionizing how investors interact with prospectuses. Artificial intelligence and machine learning platforms can scan and summarize large documents, flagging key risk factors or unusual fee structures in seconds. These innovations allow even novice investors to cut through complexity efficiently.

Moreover, growing trends toward environmental, social, and governance (ESG) investing have driven funds to increase transparency regarding sustainability-related risks and policies in their prospectuses. This shift caters to a broader base of socially-conscious investors demanding clarity on impact alongside performance.

In conclusion, learning how to actively read, interpret, and compare fund prospectuses without falling asleep gives investors the edge to make smarter, well-informed decisions. By focusing on essential sections, breaking down jargon, leveraging comparison tools, and understanding performance data, readers can transform tedious reading into empowering investment insights—setting themselves up for long-term financial success.