How to Build a Core-and-Satellite Investment Strategy

In the rapidly evolving world of investing, maintaining a balanced portfolio that aligns with your financial goals while controlling risk is crucial. One of the most effective methodologies gaining prominence is the core-and-satellite investment strategy. This approach brilliantly combines stability with growth opportunities, allowing investors to capitalize on both market efficiency and areas of potential outperformance.

The core-and-satellite strategy is grounded in blending a stable, well-diversified core portfolio with smaller, actively managed satellite holdings. This balance helps investors enjoy broad market exposure with minimal costs while pursuing aggressive returns in select sectors or asset classes. Renowned investors and financial advisors frequently endorse this approach due to its flexibility and risk management benefits. For instance, Vanguard, a leading asset management firm, promotes elements of this strategy by recommending large cap index funds for core holdings while encouraging satellite investments in specialized sectors.

An overview of this article will guide you on how to build your own core-and-satellite portfolio. You will understand how to select core and satellite investments, allocate assets appropriately, manage risk, and optimize costs over time—all bolstered by practical examples, performance data, and comparisons.

Defining the Core and Satellite Components

The core segment of your portfolio typically consists of broad-based, low-cost, passively managed funds or ETFs that represent a diversified exposure to the overall market. These core investments often cover large market capitalizations across equity and fixed income instruments. Their primary purpose is to provide long-term stability and consistent market returns, usually mirroring the broader indexes such as the S&P 500 or the Bloomberg Barclays Aggregate Bond Index.

For example, an investor might allocate 70-80% of their portfolio to core investments like the Vanguard Total Stock Market ETF (VTI) or the iShares Core U.S. Aggregate Bond ETF (AGG). These funds offer significant diversification, reducing specific company or sector risk, and have historically delivered average annual returns around 7% for equities and 3% for bonds over the past decade (Morningstar, 2023).

The satellite portion, meanwhile, consists of smaller, actively managed holdings or specialized funds aimed at capitalizing on growth opportunities or tactical advantages. These can include sector ETFs, international funds, real estate investment trusts (REITs), small-cap stocks, or thematic picks such as clean energy or technology innovation. Satellite investments typically constitute 20-30% of the portfolio and tend to have higher volatility but also present the opportunity for above-average returns.

A real-world example is BlackRock’s iShares MSCI Emerging Markets ETF (EEM) that acts as a satellite in many portfolios. Emerging markets can offer higher growth rates (averaging 10% returns in recent years according to MSCI) but come with risks like geopolitical instability and currency fluctuations.

Strategic Asset Allocation and Risk Management

Allocating assets correctly between core and satellite elements is vital for managing risk and optimizing returns. A commonly recommended allocation is 70% core and 30% satellite; however, this can adjust based on individual risk tolerance, investment horizon, and financial goals. Younger investors with a higher risk appetite might push their satellite allocation to 40%, while conservative retirees might limit satellite exposure to under 20%.

When constructing the core, emphasizing diversification across asset classes, geographies, and market capitalizations is essential. Most investment professionals suggest a mix of equities and bonds tailored to your risk profile. For instance, a 60/40 stocks-to-bonds split is classic, balancing growth with fixed-income stability. Using low-cost ETFs like Fidelity ZERO Total Market Index Fund (FZROX) for stocks and Vanguard Total Bond Market ETF (BND) can provide this diversified foundation efficiently.

The satellite portfolio focuses on sectors or themes believed to outperform or offer diversification benefits. Risk management involves careful research and periodic portfolio reviews to avoid overexposure to volatile or correlated assets. For example, if you add a satellite investment in a biotech ETF (e.g., ARKG), monitoring industry developments and broader healthcare trends is critical to avoid bubbles or underperformance periods.

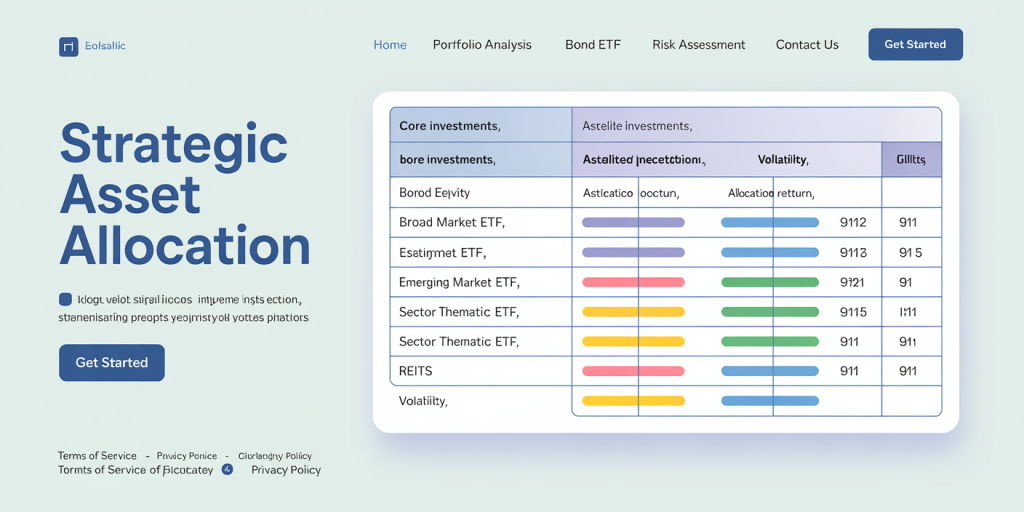

The following table summarizes a sample core-and-satellite allocation with estimated risk-return profiles:

| Portfolio Segment | Investment Type | Allocation | Estimated Annual Return (10-year avg) | Volatility (Standard Deviation) |

|---|---|---|---|---|

| Core | Broad Market Equity ETFs | 50% | 7.0% | 14% |

| Core | Aggregate Bond ETFs | 20% | 3.0% | 5% |

| Satellite | Emerging Market Equity ETFs | 15% | 9.5% | 20% |

| Satellite | Sector/Thematic ETFs (Tech, Biotech) | 10% | 12.0% | 25% |

| Satellite | Real Estate Investment Trusts (REITs) | 5% | 8.5% | 17% |

This allocation balances growth potential with portfolio stability, using data sourced from Morningstar and Vanguard performance reports (2023).

Selecting Core Holdings: Index Funds and ETFs

Choosing the appropriate core holdings involves prioritizing low-cost, diversified funds that reflect broad market performance. Index funds and ETFs are the preferred vehicles due to their efficiency, transparency, and historically superior long-term returns compared to actively managed mutual funds. Additionally, their low expense ratios help minimize fees, which is a critical factor in compounding returns over decades.

Among the most popular core investment funds are the Vanguard Total Stock Market ETF (VTI) with an expense ratio of 0.03%, and the Schwab U.S. Aggregate Bond ETF (SCHZ) with 0.04%. Both provide exposure to thousands of securities, smoothing out market fluctuations and lowering unsystematic risk.

Practical considerations when selecting core funds include: Liquidity: High trading volumes ensure ease of entry and exit. Tracking Error: Minimal deviation from the benchmark index. Tax Efficiency: ETFs generally provide more favorable tax treatment than mutual funds. Global Exposure: Combining domestic and international index funds improves diversification.

Case in point, a retiree invested 75% of their portfolio in VTI and BND over 15 years, achieving an average annual return of 6.5% with controlled volatility allowing them to sustain withdrawals during market downturns (Fidelity case study, 2022).

Designing Satellite Investments: Targeted Growth and Tactical Plays

Satellite investments generally focus on market segments or strategies that could outperform broad markets but come with additional risks. This portion is where investors can adjust for their views on market trends, leverage emerging sectors, or diversify beyond traditional assets.

For example, an investor bullish on clean energy might allocate 10-15% to ETFs like iShares Global Clean Energy ETF (ICLN) or Invesco Solar ETF (TAN). Historical data indicates clean energy assets delivered an average 15% annual return from 2015-2021, outperforming the S&P 500 in many years (BloombergNEF, 2023). However, these gains come with heightened volatility due to regulatory changes or commodity price swings.

Other satellite examples include: Emerging Markets (e.g., iShares MSCI Emerging Markets ETF – EEM) Small-cap stocks (e.g., Vanguard Small-Cap ETF – VB) Real Estate (e.g., Vanguard Real Estate ETF – VNQ) Thematic innovation funds (e.g., ARK Innovation ETF – ARKK)

Investors should monitor these holdings regularly, rebalancing or trimming positions if market conditions or fundamentals change. Using stop-loss orders or setting portfolio caps helps manage downside risk.

Cost Efficiency and Tax Implications

Implementing a core-and-satellite strategy can be highly cost-efficient when using low-fee index ETFs for core holdings, balancing out the typically higher transaction costs and management fees of satellite assets. According to a 2023 report by the Investment Company Institute, the average expense ratio for index funds is 0.06%, significantly lower than the 0.75% for active funds.

Minimizing costs can add thousands of dollars to your portfolio value over time. For example, a $100,000 portfolio with a 1% annual fee deducts nearly $1,000 yearly, which compounds substantially. In contrast, a blended expense ratio of 0.15% (typical for a core-and-satellite mix) saves over $850 yearly compared to a fully active strategy.

Tax efficiency is another important consideration. Core ETFs tend to generate fewer capital gains distributions, making them more tax-friendly in taxable accounts. Satellites, especially actively managed ones, may trigger higher gains and dividend taxes. Strategies such as placing bond funds in tax-advantaged accounts (IRAs, 401(k)s) or tax-loss harvesting can reduce tax burdens.

Future Perspectives: Adapting the Core-and-Satellite Strategy in Changing Markets

As financial markets evolve, the core-and-satellite investment strategy remains adaptable to new trends, technologies, and global shifts. Increasingly, investors are incorporating environmental, social, and governance (ESG) principles into core holdings, mirroring growing demand for responsible investing. Core funds such as the iShares ESG Aware MSCI USA ETF (ESGU) provide a diversified yet sustainable market exposure.

On the satellite front, technological innovation, such as artificial intelligence and blockchain, is creating fresh opportunities. The key will be balancing enthusiasm with disciplined research to avoid speculative excess. Additionally, geopolitical uncertainties and inflationary pressures call for flexible portfolio adjustments, emphasizing inflation-protected bonds or commodities in the satellite bucket.

Robo-advisors and algorithm-driven platforms are enhancing the ease of managing core-and-satellite portfolios, offering automatic rebalancing, tax optimization, and personalized advice. According to a 2023 Deloitte study, over 30% of retail investors adopted automated advice platforms, which streamline this strategy’s implementation for newcomers.

In conclusion, the core-and-satellite strategy is a practical framework that balances long-term market exposure with tactical growth opportunities. By carefully selecting diversified core funds, strategically allocating satellites, and managing costs and risks, investors can build resilient portfolios that adapt to market dynamics and optimize wealth growth consistently over time. Embracing innovation and staying informed on market trends will be critical to maximizing the future potential of this timeless investing approach.