How to Create a Tax-Efficient Investment Strategy

Tax efficiency is a critical component of successful investing, as it directly impacts the net returns an investor ultimately receives. By strategically planning investments and leveraging tax-advantaged accounts, individuals can significantly reduce their tax liability and increase the growth potential of their portfolios. This article explores practical approaches to building a tax-efficient investment strategy, supported by real examples and comparative data. Whether you are a novice investor or an experienced portfolio manager, understanding these principles can help you keep more of your earnings over time.

The Importance of Tax Efficiency in Investing

Tax efficiency refers to minimizing the tax burden on investment returns, including dividends, interest, and capital gains. With federal and state tax rates varying widely—long-term capital gains, for example, can be taxed anywhere from 0% to 20% depending on income brackets, plus additional surtaxes—planning around these can enhance overall wealth accumulation.

Consider a hypothetical investor who earns a consistent 7% annual return before taxes. If half of the returns are subject to a 15% capital gains tax, the after-tax return drops to approximately 6.475%. While this might appear incremental, over 30 years, the difference compounds significantly. According to a study by the MIT Sloan School of Management, an investor can increase wealth by nearly 28% simply by employing tax-efficient investment strategies. This highlights why taxes should be a key consideration when constructing portfolios.

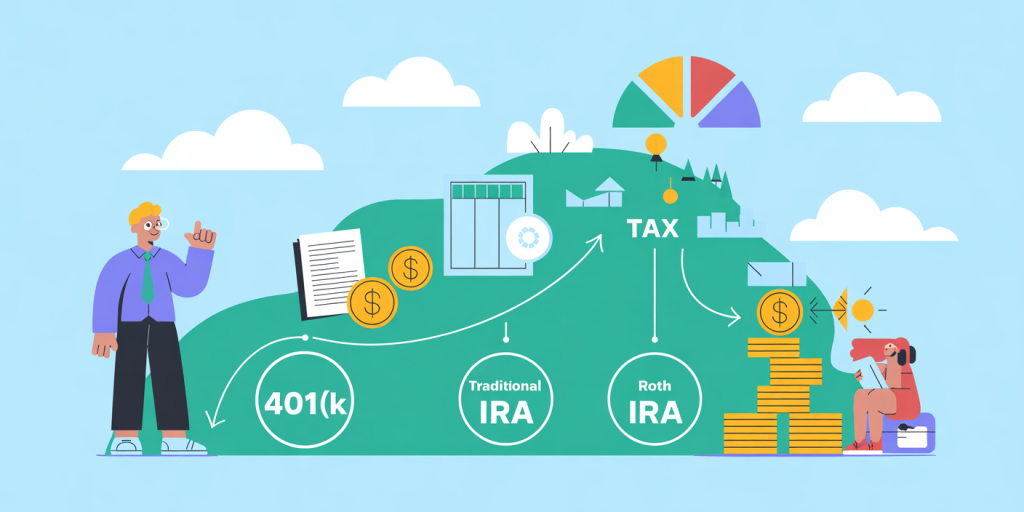

Utilizing Tax-Advantaged Accounts

One of the foundational steps in creating a tax-efficient investment strategy is maximizing contributions to tax-advantaged accounts like 401(k)s, IRAs, and Roth IRAs. These accounts offer various tax benefits that can compound over time.

For example, traditional 401(k) plans allow pre-tax contributions, reducing taxable income in the contribution year. Taxes are deferred until withdrawals begin, ideally when the investor is in a lower tax bracket post-retirement. On the other hand, Roth IRAs involve after-tax contributions but allow tax-free withdrawals of earnings after age 59½, assuming certain conditions are met. The choice between these depends on an individual’s current tax rate versus their anticipated rate during retirement.

A practical case study: Sarah, a 35-year-old professional, contributes $6,000 annually to her Roth IRA while simultaneously maximizing her employer’s 401(k) match. By prioritizing these accounts, Sarah minimizes her current tax burden and accesses tax-free growth. Over 30 years, with a 7% average return, Sarah’s $180,000 contributions could grow to approximately $540,000 tax-free, which would otherwise be significantly reduced by capital gains taxes outside these accounts.

| Account Type | Contribution Limits (2024) | Tax Treatment on Contributions | Tax Treatment on Withdrawals |

|---|---|---|---|

| 401(k) | $22,500 (+ $7,500 catch-up if 50+) | Pre-tax | Taxed as ordinary income |

| Traditional IRA | $6,500 (+ $1,000 catch-up if 50+) | May be tax-deductible depending on income | Taxed as ordinary income |

| Roth IRA | $6,500 (+ $1,000 catch-up if 50+) | After-tax | Tax-free if qualified |

Maximizing these accounts should be a priority before investing in taxable brokerage accounts since the latter lacks the inherent tax advantages.

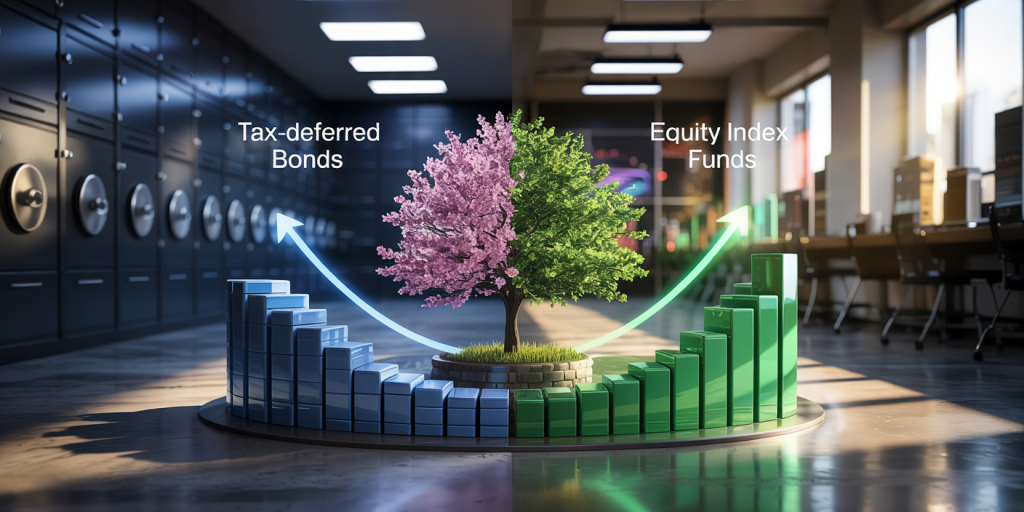

Asset Location: Where to Place Different Investments

Beyond tax-advantaged accounts, asset location—the strategic placement of investments across taxable and tax-deferred accounts—is an often overlooked but powerful aspect of tax-efficient investing.

Certain assets generate taxable income more frequently or at higher rates. For instance, bonds produce regular interest income, typically taxed as ordinary income, often at higher rates than capital gains. Conversely, equities may generate dividends and capital gains, but qualified dividends and long-term capital gains often benefit from favorable tax rates.

By housing high-yield bonds and taxable bond funds in tax-deferred accounts like IRAs or 401(k)s, investors defer or avoid current taxation of the interest income. Meanwhile, placing index equity funds that generate low turnover and qualified dividends in taxable accounts leverages the lower capital gains tax rates and offsetting losses from tax-loss harvesting.

A comparative table highlights typical tax efficiency by asset class:

| Asset Class | Tax Treatment | Recommended Account Type |

|---|---|---|

| U.S. Treasury Bonds | Interest taxed as ordinary income | Tax-advantaged accounts |

| Municipal Bonds | Typically tax-free federally | Taxable or tax-advantaged |

| Equity Index Funds | Qualified dividends, capital gains | Taxable accounts preferred |

| REITs (Real Estate Investment Trusts) | Ordinary income tax on most distributions | Tax-advantaged accounts |

A real-life illustration involves John, who allocated his municipal bonds in taxable accounts since their interest is generally exempt from federal income tax. He complemented this with equity index funds in taxable accounts to benefit from long-term capital gains rates, while placing taxable bonds generating lots of interest in his 401(k). This mix reduced his annual portfolio-wide tax liability by an estimated 20%.

Tax-Loss Harvesting: Turning Losses into Gains

Tax-loss harvesting is the practice of selling securities at a loss to offset taxable capital gains elsewhere in the portfolio, thereby reducing the investor’s tax bill.

For example, assume an investor realizes $10,000 in capital gains during the year. If the same investor sells other underperforming securities at a $7,000 loss, they only pay tax on $3,000 of net capital gains. This strategy can be repeated annually and even rolled over multiple years by carrying over unused losses.

The efficiency of this strategy depends on market fluctuations, portfolio turnover, and the investor’s ability to wait to repurchase the same or similar securities to avoid wash-sale rules, which disallow claiming the loss if the same security is bought within 30 days before or after the sale.

A practical example: Emily held shares in two tech companies during a downturn. She sold the underperforming stock at a loss, offsetting taxable gains from her profitable stock sales. By reinvesting after 31 days, she maintained exposure to the sector without realizing unwanted losses.

| Year | Capital Gains Realized | Losses Harvested | Net Capital Gains | Tax Rate on Gains | Tax Paid |

|---|---|---|---|---|---|

| 2022 | $15,000 | $5,000 | $10,000 | 15% | $1,500 |

| 2023 | $8,000 | $10,000 | $0 | 15% | $0 |

By applying this strategy consistently, investors can smooth tax liabilities and improve after-tax returns, especially in volatile markets.

Choosing Tax-Efficient Investment Vehicles

The type of investment vehicle selected also plays a big role in tax efficiency. Exchange-Traded Funds (ETFs) and index funds, due to their lower turnover rates, generally produce fewer taxable events compared to actively managed mutual funds.

ETFs employ an “in-kind” redemption mechanism, which limits capital gains distributions. On the contrary, actively managed mutual funds may frequently buy and sell holdings, realizing capital gains that flow through to investors yearly.

Data from Morningstar indicates that over a 10-year period, ETFs returned an average after-tax yield 1.5% higher than actively managed mutual funds with comparable gross returns. This gap becomes more significant in higher tax brackets.

For instance, a high-earner investing $50,000 a year for 20 years in tax-efficient ETFs could potentially have tens of thousands of dollars more in after-tax wealth compared to someone investing in an actively managed fund that incurs frequent capital gains distributions.

International funds, however, may result in foreign tax withholding, thus influencing their tax efficiency depending on individual treaties and credits. Investors should factor those considerations when building global portfolios.

Future Perspectives: Evolving Tax Policies and Technology

The landscape of tax-efficient investing is subject to regulatory changes and technological advancements, which necessitates staying informed and adaptable.

Recently, legislative proposals in various countries aim to modify capital gains tax rates, inheritance tax rules, and reporting requirements on investment income. For example, upcoming changes in U.S. tax legislation could introduce higher capital gains taxes for high-income earners, urging investors to reconsider timing of asset sales and implementing even more robust tax-deferral measures.

On the technology front, artificial intelligence and robo-advisors now offer personalized tax optimization advice using real-time data analysis. These tools automate tax-loss harvesting and suggest optimal asset allocations, saving investors time and enhancing tax efficiency.

Furthermore, blockchain technology and tokenized assets may revolutionize record-keeping and transaction transparency, potentially simplifying future tax reporting and compliance.

Investors should regularly review their strategies and consult financial professionals to integrate these developments proactively.

Creating a tax-efficient investment strategy requires a multi-faceted approach—maximizing tax-advantaged accounts, intelligent asset location, leveraging tax-loss harvesting, and choosing suitable investment vehicles. When executed thoughtfully, these steps can significantly improve after-tax returns and accelerate wealth accumulation. As tax laws evolve and technology advances, maintaining a flexible and informed outlook will remain crucial for optimizing investment outcomes.