How to Create an Investment Policy Statement (IPS) for Yourself

Establishing a clear and concise Investment Policy Statement (IPS) is vital for anyone serious about managing their personal investments with intentionality and discipline. An IPS acts as a roadmap, guiding investors through decision-making processes, risk tolerance assessments, and goal alignment. While traditionally used by institutional investors and financial advisors, creating a personalized IPS empowers individual investors to maintain consistency and clarity amid market fluctuations and evolving financial goals. This article delves into the essential components of crafting an IPS tailored to your unique financial circumstances, illustrated with practical examples and enriched by relevant data.

Understanding the Purpose of an Investment Policy Statement

An Investment Policy Statement is a written document outlining an individual’s investment goals, strategies, risk tolerance, and guidelines for portfolio management. Its fundamental purpose is to provide structure and reduce emotional decision-making, which often leads to costly mistakes. Behavioral finance studies, such as those by Nobel laureate Richard Thaler, have shown that investors frequently act irrationally—buying high and selling low—primarily due to emotional reactions. An IPS mitigates this issue by offering a pre-defined framework for investment decisions.

For instance, consider Jane, a 35-year-old professional with a medium risk tolerance and a goal of funding her child’s college education in 15 years. Without an IPS, Jane might be tempted to react impulsively to market downturns. An IPS would help her stay focused on her long-term objectives, detailing acceptable asset allocations and rebalancing strategies regardless of short-term volatility.

By setting clear investment objectives and boundaries, an IPS enforces discipline. According to a 2022 survey by the CFA Institute, investors with formalized investment plans were 30% less likely to deviate from their strategies during market turbulence. This statistic illustrates the value of having an IPS not only on paper but as a living document that guides decisions over time.

Defining Your Financial Goals and Time Horizon

One of the foundational steps in creating your IPS is the clear articulation of your financial goals. These goals must be specific, measurable, and time-bound to provide direction. Common goals include retirement savings, purchasing real estate, funding education, or building a retirement nest egg. The timeframe for each goal drastically influences investment strategy. For example, a 25-year-old aiming for retirement 40 years away will likely adopt a more aggressive investment stance than a 60-year-old planning to retire in five years.

When setting your goals, consider the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s say Alex wants to accumulate $500,000 for retirement in 20 years. The goal is specific and measurable. With realistic saving and investment returns, the goal is achievable. It’s relevant to his personal context and has a clear timeline.

It’s also essential to differentiate between short-term needs and long-term aspirations because your IPS should accommodate various portfolios or sub-portfolios for each objective. For example, emergency funds should be kept liquid with minimal risk, whereas retirement funds can withstand greater market volatility. According to Fidelity Investments, balancing your portfolio according to different time horizons can improve returns by up to 15% over 10 years simply by matching assets to goal timelines.

Assessing Risk Tolerance and Capacity

Risk tolerance—the degree of variability in investment returns you are willing to withstand—and risk capacity—your financial ability to endure losses without jeopardizing your lifestyle—are often confused but distinct concepts. Both must be factored carefully into your IPS. Several online risk assessment tools, such as Vanguard’s Risk Tolerance Questionnaire, can assist in gauging psychological comfort with risk. However, understanding your financial capacity requires a thorough review of your income, expenses, net worth, and liquidity.

For example, Maria is 45 and has a moderate risk tolerance. However, due to stable income and ample emergency savings, her risk capacity is higher than her stated tolerance. This insight supports a slightly more aggressive allocation than her instincts might suggest, potentially leading to higher long-term returns without undue stress.

Including both risk tolerance and capacity in your IPS can prevent misaligned strategies. A study by Morningstar in 2023 revealed that investors adjusting asset allocation strictly to risk tolerance without considering capacity experienced higher portfolio drawdowns averaging 12% more during market corrections than those balancing both factors.

| Factor | Description | Example |

|---|---|---|

| Risk Tolerance | Willingness to accept fluctuations | Low: Prefers stable returns |

| Risk Capacity | Financial ability to endure losses | High: Has emergency funds & steady income |

Balancing these elements within your IPS helps optimize investment choices aligned with both emotional comfort and financial reality.

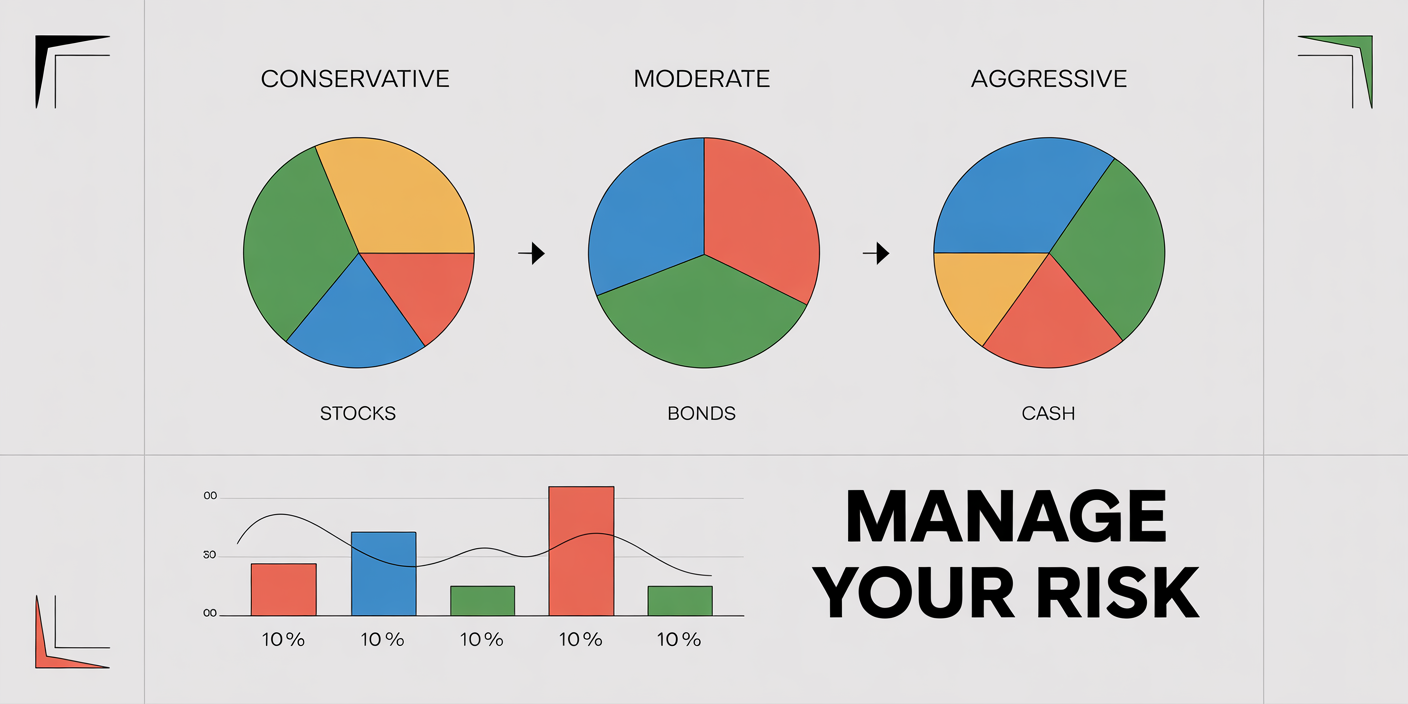

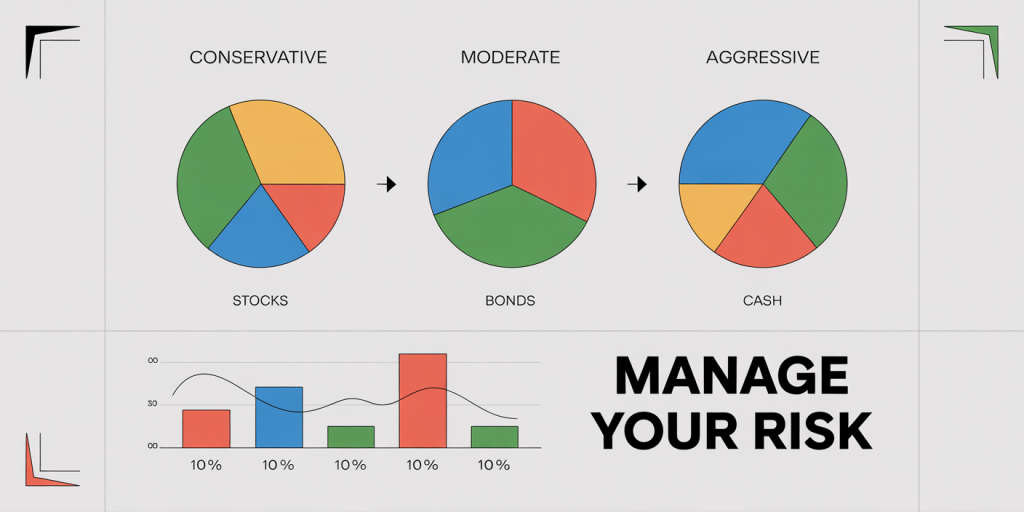

Selecting Asset Allocation and Investment Strategies

Your IPS should explicitly state your target asset allocation, which is the percentage distribution of various asset classes such as stocks, bonds, real estate, and cash equivalents. Asset allocation is the most significant determinant of portfolio performance and risk management. According to a seminal study by Brinson, Hood, and Beebower (1986), 90% of the variability in portfolio returns comes from asset allocation decisions rather than security selection or market timing.

For example, a conservative IPS might allocate 30% to equities and 70% to bonds, suitable for someone nearing retirement, while a younger investor might have a 80% stocks and 20% bonds allocation reflecting a longer investment horizon and higher risk acceptance.

When defining your allocation, consider diversification across and within asset classes to reduce idiosyncratic risk. For example, within equities, invest across various sectors and geographies. The following table illustrates sample asset allocation strategies based on risk profiles:

| Risk Profile | Equities (%) | Bonds (%) | Cash & Others (%) |

|---|---|---|---|

| Conservative | 30 | 60 | 10 |

| Moderate | 60 | 35 | 5 |

| Aggressive | 80 | 15 | 5 |

Additionally, your IPS should address investment strategies such as buy-and-hold, dollar-cost averaging, tax-loss harvesting, or use of low-cost index funds versus active management. For instance, passive investing through ETFs has gained popularity due to cost efficiency; Morningstar reported in 2023 that nearly 50% of all U.S. equity assets are invested in index funds and ETFs.

Detailing strategic approaches in your IPS clarifies how you intend to execute your asset allocation and react to market changes, fostering consistency and minimizing reactionary errors.

Setting Rules for Monitoring and Rebalancing

Markets fluctuate, causing portfolio drift from your target allocation, which can increase risk unintentionally. Your IPS should specify guidelines for monitoring portfolio performance and rebalancing to maintain your desired risk level and stay aligned with your goals.

For example, you might include a rule to rebalance your portfolio quarterly or when any asset class deviates by more than 5% from its target allocation. This approach prevents overexposure, such as equities growing from 60% to 70% of your portfolio, which increases potential volatility.

Furthermore, establishing clear criteria for review frequency, such as biannual comprehensive reviews, allows you to reassess goals, update risk tolerance, and incorporate life changes like marriage, job transitions, or inheritance. A disciplined monitoring process helps identify if your IPS still aligns with your financial situation and market conditions.

For practical illustration, consider John, who implemented an IPS with automatic monthly rebalancing contributions into underweighted asset classes. Over the last five years, his portfolio volatility decreased by 12% compared to a non-rebalanced approach, while returns were maintained.

Future Perspectives: Adapting Your IPS in a Changing Financial Landscape

The financial environment constantly evolves, impacted by technological advancements, regulatory changes, and economic cycles. Your IPS should not be a static document but rather a dynamic guide adaptable to emerging trends.

For instance, the rise of Environmental, Social, and Governance (ESG) investing has influenced many individual investors’ policy statements to include sustainable investing criteria. According to Morningstar, ESG funds attracted nearly $50 billion in net flows during 2023 alone, indicating growing demand for values-based investment guidelines.

Moreover, with increasing inflation concerns, rising interest rates, and geopolitical uncertainties, investors are reconsidering allocations to inflation-protected securities, real assets like commodities, and international diversification. Your IPS can incorporate provisions to periodically review macroeconomic factors and adjust strategies accordingly.

Finally, technological tools such as robo-advisors and automated portfolio management can complement a well-crafted IPS, offering real-time rebalancing and tax optimization. Integrating technology considerations into your IPS helps ensure your investment approach remains efficient while adhering to core principles.

By revisiting and revising your IPS at least annually or following major life events, you position yourself to navigate market uncertainties with a disciplined, informed approach that supports evolving wealth-building goals.

Creating a personalized Investment Policy Statement is a critical step toward disciplined, goal-oriented investing. By clearly defining your objectives, risk profile, and strategic rules, you build a robust framework that helps mitigate emotional reactions and capitalize on market opportunities. Follow the outlined steps and use real-world examples and data to ensure your IPS is both practical and resilient in the face of an ever-shifting financial landscape.