How to Use Investment Buckets for Short, Medium, and Long-Term Goals

Managing your finances effectively requires strategic planning, especially when balancing multiple investment goals that vary in time horizon and risk tolerance. One proven method to organize investments is the “investment buckets” approach, which categorizes assets based on the timeframe and purpose they serve. This article explores how to use investment buckets for short, medium, and long-term goals, helping investors optimize returns while managing risk efficiently.

Understanding the Concept of Investment Buckets

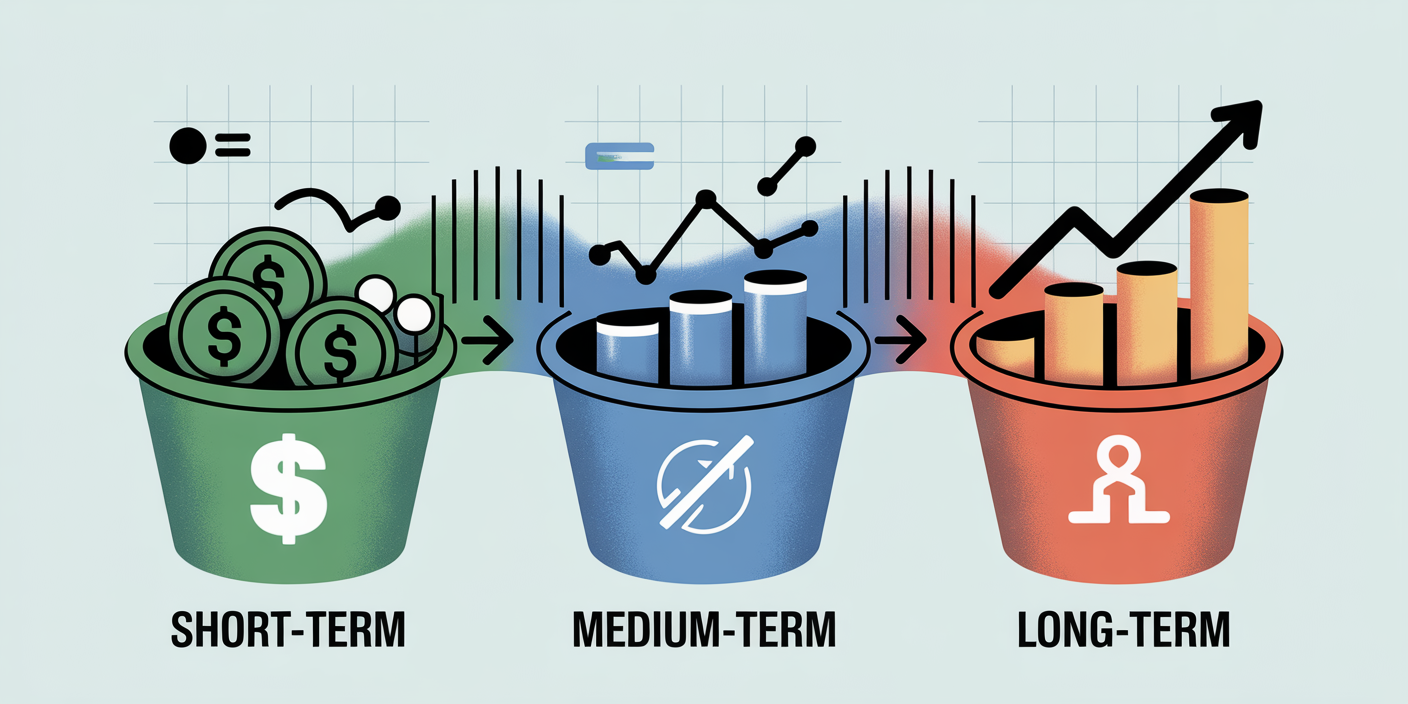

The investment buckets strategy revolves around dividing your portfolio into separate segments, each aligned with specific financial goals and timelines: short-term (0-3 years), medium-term (3-10 years), and long-term (10+ years). By segmenting investments this way, investors can tailor their asset allocation and risk profiles suitable for each goal, rather than using a one-size-fits-all approach.

A clear visual representation of the three investment buckets (short-term, medium-term, long-term) showing different asset types, timelines, and risk levels with icons or symbols for cash, bonds, and stocks.

For example, John, a 35-year-old professional, is saving for a home down payment within two years, a child’s education starting in six years, and retirement in 25 years. Utilizing investment buckets, John separates his portfolio into three parts — cash and low-risk bonds for his down payment, balanced mutual funds for education funding, and growth-focused stocks for retirement savings. This method allows John to manage risk appropriately and avoid liquidating long-term investments prematurely.

Studies show that investors applying the bucket strategy experience less anxiety during market downturns, as funds required in the short term are insulated from volatility. According to a 2021 Vanguard study, segmented investing can improve investor discipline and increase satisfaction with portfolio outcomes.

Short-Term Investment Bucket: Preserving Capital and Ensuring Liquidity

The first bucket focuses on funds needed within 0-3 years. This bucket prioritizes capital preservation, liquidity, and low volatility over high returns because the investment horizon is too short to recover from market downturns. Typical financial goals here include emergency funds, upcoming home purchases, or planned vacations.

Common assets in a short-term bucket include: High-yield savings accounts Certificates of Deposit (CDs) Treasury bills Money market funds

These vehicles typically offer low returns but protect principal and ensure quick access to funds. As per FDIC data, high-yield savings accounts currently average around 4.5% annual yield, significantly higher than traditional savings accounts of the past.

A practical example is Sarah, who needs $20,000 in three years to finance a graduate school program. She places this amount in a series of CDs laddered to mature over the next three years at varying interest rates averaging 3.8%. This minimizes risk and guarantees the availability of funds when needed.

| Asset Type | Typical Return (Annual) | Risk Level | Liquidity |

|---|---|---|---|

| High-Yield Savings Account | 4.5% | Very Low | High (daily access) |

| Certificates of Deposit | 3-4% | Very Low | Low (penalties for early withdrawal) |

| Treasury Bills | 3-4% | Very Low | High (secondary market available) |

| Money Market Funds | 3-4% | Low | High |

Risks to avoid in the short-term bucket include equities or volatile assets that may depreciate just before funds are needed. Sudden market downturns can jeopardize short-term goals if funds are forced to be sold in unfavorable conditions.

Medium-Term Investment Bucket: Balancing Growth with Moderated Risk

The medium-term bucket covers goals with a horizon between three and ten years, such as buying a home, funding a child’s college tuition, or starting a business. Investors can tolerate moderate volatility because there is some time to ride out fluctuations, but safety remains important.

This bucket typically combines a diversified mix of: Balanced mutual funds (blend of stocks and bonds) Index funds Corporate bonds and bond funds Dividend-paying stocks

The objective is to achieve moderate growth with a buffer against inflation, while limiting exposure to market shocks. For instance, a 60% stock and 40% bond allocation is commonly recommended for medium-term goals, reflecting a blend of growth and stability.

Consider Mark and Lisa, who intend to buy a house in seven years. They invest $50,000 in a balanced fund with exposure to large-cap stocks and investment-grade bonds. Over seven years, their portfolio grows an average of 6-7% annually, outperforming conservative savings accounts but without the high volatility of a pure equity portfolio.

According to Morningstar data, moderate-risk balanced funds returned approximately 6.5% annually over the past decade, with standard deviations significantly lower than equity-only funds. This suggests a reasonable compromise between growth and risk.

| Asset Class | Expected Return (Annual) | Volatility (Std Dev) | Role in Medium-Term Bucket |

|---|---|---|---|

| Balanced Mutual Funds | 6-7% | Moderate | Moderate growth with risk mitigation |

| Corporate Bonds | 4-5% | Low to Moderate | Income and stability |

| Dividend Stocks | 5-7% | Moderate | Income plus capital appreciation |

| Index Funds (S&P 500) | ~7-10% (long term) | High | Growth potential with volatility |

Investors should periodically rebalance the bucket to maintain the desired asset allocation. Rebalancing prevents risk creep due to equity appreciation and helps lock in gains by selling high-risk assets when appropriate.

Long-Term Investment Bucket: Maximizing Growth through Equity Exposure

The long-term bucket encompasses goals beyond ten years, predominantly retirement savings or wealth accumulation for future generations. Given the extended horizon, these investments can withstand significant market volatility as they have time to recover from downturns.

The core focus is on maximizing growth through primarily equity-based investments: Individual stocks Growth-focused mutual funds or ETFs Real estate investment trusts (REITs) International stocks

Historical data affirms that equities provide superior long-term growth. The S&P 500 has achieved average annualized returns of roughly 10% over the last century, despite intermittent bear markets. This growth significantly outpaces inflation and fixed income returns.

Take the case of Emily, who began saving for retirement at age 30 by investing primarily in an S&P 500 index fund. Over 35 years, her portfolio experienced annualized returns of approximately 10%, growing her initial investment from $50,000 to over $700,000 (assuming reinvestment and no withdrawals).

| Asset Class | Long-Term Average Return | Volatility | Typical Role in Long-Term Bucket |

|---|---|---|---|

| Large-Cap Stocks | ~10% | High | Core growth driver |

| International Stocks | 8-10% | High | Diversification and growth |

| REITs | 8-12% | High | Income and inflation hedge |

| Small and Mid-Cap Stocks | 10-12% | Very High | High growth potential |

Investors should be mindful, however, that equity markets can experience severe downturns even over multi-year periods, such as during the 2008 financial crisis or the 2020 pandemic-induced sell-off. Nonetheless, a disciplined long-term approach, including dollar-cost averaging and periodic portfolio reviews, helps mitigate these risks.

An infographic-style table comparing asset classes for each bucket, including typical returns, risk levels, and liquidity, illustrating how investors allocate funds across short, medium, and long-term goals.

Rebalancing and Adjusting Buckets Over Time

As life circumstances, market conditions, and financial goals evolve, adjusting the composition and size of each investment bucket is essential. Rebalancing ensures that the portfolio aligns with changes in risk tolerance, time horizons, and capital needs.

For instance, as you approach a goal in the medium-term bucket – say, a child’s college tuition in five years – shifting assets from higher-risk equities to bonds or cash instruments reduces the risk of loss before the funds are needed. Similarly, when nearing retirement, the long-term bucket should be gradually de-risked, moving from aggressive growth stocks to more conservative fixed-income securities.

A conceptual image depicting an investor’s journey over time, showing portfolio rebalancing and shifting asset allocations from growth-focused stocks to safer bonds and cash as retirement approaches.

Consider David, a 50-year-old investor whose retirement timeline in the long-term bucket shortens each year. As retirement nears, David shifts 10% of his long-term allocation into bonds annually, effectively moving funds toward stability and income generation. This “glide path” approach is common among target-date funds.

| Investment Bucket | Age 30 Allocation (%) | Age 50 Allocation (%) | Age 65 Allocation (%) |

|---|---|---|---|

| Short-Term | 10 | 15 | 25 |

| Medium-Term | 30 | 35 | 30 |

| Long-Term | 60 | 50 | 45 |

Data from Vanguard’s Target Retirement Funds indicate that as investors age, portfolios strategically reduce equity exposure to mitigate sequence of returns risk while continuing to generate income from safer assets.

Practical Benefits and Limitations of the Bucket Approach

Using investment buckets provides a structured framework to align risk and returns with specific goals, resulting in several benefits: Enhanced peace of mind knowing short-term funds are safe and liquid. Reduced likelihood of emotional reactions to market volatility by separating funds by horizon. Clarity in financial planning, making it easier to track progress for each goal. Flexibility to adjust allocations without impacting unrelated goals.

However, the strategy also has limitations. Segregating funds may reduce diversification benefits since assets are not combined into a single portfolio. Additionally, managing multiple accounts and allocations can be complex and requires discipline.

A real-world example comes from a 2022 financial advisory survey, where 78% of advisors said clients employing buckets felt more confident and less likely to sell during downturns. Yet, 34% noted clients needed guidance to avoid overcomplicating their portfolio structure.

Future Perspectives: Evolving Investment Buckets in a Changing Financial Landscape

The investment buckets approach is likely to evolve, innovating with financial technology, evolving asset classes, and growing investor expectations. Robo-advisors already offer automated portfolio segmentation aligned with bucket strategies, providing tailored rebalancing and tax optimization. This automation improves efficiency and reduces manual management errors.

Cryptocurrency and alternative investments are also poised to be incorporated within buckets, especially for medium and long-term growth, although volatility remains a concern.

Sustainable investing trends will also influence bucket allocations, as Environmental, Social, and Governance (ESG) criteria gain prominence. Investors may choose ESG-compliant funds within their buckets, aligning financial goals with personal values.

Additionally, the growing importance of retirement income planning will encourage integration of bucket approaches with income-focused strategies, such as annuities or dividend strategies in the long-term bucket.

Ongoing academic research and market innovations will further refine best practices, enhancing customization and responsiveness to individual investor circumstances.

—

Using the investment buckets strategy empowers investors to pursue multiple financial goals by matching risk and returns to respective time horizons. By safeguarding short-term capital, taking measured risks in the medium term, and maximizing growth for the long haul, investors create robust, resilient portfolios designed for success. With emerging technologies and evolving markets, these buckets will become even more dynamic tools in personal finance management.