Investing with Purpose: How to Build a Values-Based Portfolio

In recent years, investing has evolved beyond mere financial returns. Investors are increasingly seeking to align their capital with personal values, societal impact, and environmental responsibility. Building a values-based portfolio allows individuals to support causes such as environmental sustainability, social justice, corporate governance, and ethical business practices, all while pursuing financial growth. This approach, often referred to as socially responsible investing (SRI), impact investing, or ESG (Environmental, Social, and Governance) investing, is gaining momentum across global markets.

According to a 2023 report by the Global Sustainable Investment Alliance, sustainable investing assets reached $40.5 trillion globally, representing a 15% increase over two years. This surge illustrates a growing recognition that investment decisions can drive meaningful change. This article explores how to construct a values-based portfolio, offering practical examples, data-driven insights, and comparative analyses to empower investors who wish to invest with intention.

Defining Values-Based Investing

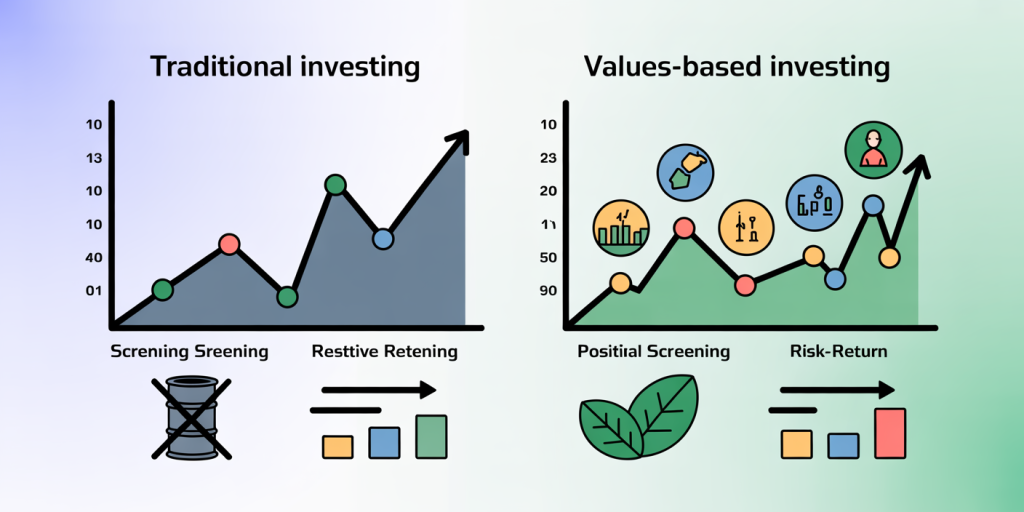

Values-based investing encompasses strategies that incorporate personal ethics and societal impact into investment decisions. Unlike traditional investing, which prioritizes maximum financial return, values-driven investing balances financial goals with the investor’s principles.

There are several approaches within this framework. Negative screening excludes industries or companies that conflict with the investor’s values—such as tobacco, fossil fuels, or firearms. Positive screening, conversely, focuses on companies excelling in ESG metrics, rewarding firms committed to sustainability and inclusivity. Integration of ESG factors into financial analysis constitutes another method, blending traditional financial performance metrics with social responsibility considerations.

For example, BlackRock, the world’s largest asset manager, has integrated ESG factors into over $1 trillion of assets under management. This trend reflects a shift in the investment landscape from purely profit-driven decisions toward multidimensional evaluation criteria that include social responsibility.

Steps to Building a Values-Based Portfolio

Creating a values-based portfolio requires clarity regarding one’s values and dedicating time to research and strategy formulation. The first step is to identify what matters most to you—whether it’s environmental protection, social equity, or corporate ethics—and translate that into investment criteria.

Once these priorities are established, the investor should assess investment options. Sustainable mutual funds, exchange-traded funds (ETFs), and green bonds have emerged as accessible vehicles. For instance, the iShares MSCI KLD 400 Social ETF focuses on companies with strong ESG ratings while avoiding controversial sectors, allowing investors to align with social values without sacrificing diversification. Additionally, green bonds finance projects with environmental benefits, such as renewable energy installations or energy-efficient building retrofits.

A practical example: A retiree committed to combating climate change might select a mix of clean energy ETFs, green bonds, and direct investments in companies with transparent carbon reduction goals. This strategy blends financial prudence with impact objectives.

Comparing Traditional vs. Values-Based Portfolios: Risk and Return Perspectives

A common concern is whether values-based investing compromises return potential. This perception is gradually being disproven by numerous studies and real-world performance data.

| Criteria | Traditional Portfolio | Values-Based Portfolio |

|---|---|---|

| Investment Criteria | Financial returns only | Financial returns + ethical impact |

| Industry Exposure | Broad, including non-ethical sectors | Selective, excluding harmful industries |

| Risk Profile | Market and financial risk | Includes ESG risk factors, potentially reducing long-term risk |

| Historical Returns (5Y) | Average annual return ~7% (varies) | Average annual return ~6.5%-8%, depending on fund |

| Volatility | Standard market volatility | Comparable or lower volatility due to ESG risk mitigation |

Numerous ESG funds have performed competitively. For example, the MSCI KLD 400 Social Index has historically delivered returns on par with the broader S&P 500 while exhibiting slightly lower risk. This trend is supported by research from Morgan Stanley’s Institute for Sustainable Investing, which found that sustainable equity funds outperformed their counterparts by a median of 0.84% annually over a decade.

In essence, values-based portfolios may provide resilience against long-term risks such as regulatory changes, reputational damage, and environmental disruptions, factors increasingly relevant in today’s evolving markets.

Practical Tools and Resources to Identify Values-Aligned Investments

Technological advancements and data transparency have made it easier than ever to build a portfolio aligned with personal values. Investors can access ESG ratings, sustainability reports, and third-party analyses when selecting assets.

Platforms like MSCI ESG Ratings, Sustainalytics, and Morningstar’s Sustainability Ratings offer detailed insights on thousands of publicly traded companies, assessing metrics such as carbon emissions, human rights records, and board diversity. These tools enable investors to move beyond brand reputation and analyze actual company practices.

For individual investors, robo-advisors such as Betterment and Wealthsimple provide ESG-focused portfolios tailored to client values and risk tolerance. Similarly, mutual funds like the TIAA-CREF Social Choice Equity Fund invest in companies meeting strict ESG criteria.

Additionally, impact investing networks and nonprofit organizations often publish thematic reports and investment guides. For example, the Forum for Sustainable and Responsible Investment (US SIF) offers comprehensive data and resources to help investors understand market trends and screen investments based on values.

Balancing Financial Goals and Social Impact: Portfolio Diversification Strategies

One of the challenges in values-based investing is maintaining portfolio diversification while adhering strictly to ethical criteria. Restrictive screens can limit investment universes and inadvertently increase concentration risk.

To mitigate this, it is crucial to employ a strategic mix of asset classes and investment types. Diversification across sectors such as technology, healthcare, and consumer goods—while excluding controversial industries—helps balance risk and return.

A balanced values-based portfolio might include: Equities: ESG-focused ETFs or individual stocks from companies with strong sustainability records. Fixed Income: Green and social bonds issued by municipalities or corporations. Alternatives: Impact private equity funds or real assets like sustainable real estate.

Consider the case of Patagonia’s Common Threads Fund, which invests exclusively in companies committed to environmental stewardship and social justice while aiming for market-based returns. Such specialized funds illustrate how values-based diversification can be pursued effectively.

Moreover, frequent portfolio reviews and rebalancing are essential. ESG data and company practices evolve, necessitating ongoing due diligence to ensure alignment with values.

Future Perspectives: The Growing Influence of Values-Based Investing

Looking ahead, values-based investing is predicted to play an increasingly dominant role in the global financial ecosystem. A survey by Morningstar in 2024 found that 85% of individual investors consider sustainability factors important when making investment decisions, a significant increase over the past five years.

Regulatory frameworks are responding accordingly. The European Union’s Sustainable Finance Disclosure Regulation (SFDR) requires asset managers to disclose sustainability risks, enhancing transparency. Similar initiatives are underway in the United States and Asia, indicating a global push towards standardized ESG reporting.

Technological innovations such as blockchain may soon offer real-time impact tracking, allowing investors to measure their social and environmental contributions accurately. Additionally, artificial intelligence is enhancing ESG analytics, uncovering patterns and risks invisible through traditional research methods.

Company behaviors are also evolving. More firms commit to net-zero emissions, diversity enhancement, and ethical governance to attract capital from conscientious investors. For example, Microsoft pledged to become carbon negative by 2030, a commitment that appeals to values-based shareholders.

Investors who prioritize values-based portfolios will likely benefit not only from potential financial gains but also from participating in a transformative movement shaping markets to reflect community and planet-centric priorities.

This comprehensive exploration of investing with purpose highlights that building a values-based portfolio is both feasible and increasingly advantageous. By identifying personal priorities, leveraging reliable ESG data, balancing diversification, and staying informed on market trends, investors can create portfolios that generate returns while advancing positive social and environmental outcomes. As the investment landscape continues to shift, those embracing values-based strategies position themselves for a future where finance and ethics are seamlessly integrated.