Risk Tolerance vs. Risk Capacity: What You Can Handle vs. What You Should

Making sound financial decisions requires a deep understanding of both risk tolerance and risk capacity—two concepts often used interchangeably but fundamentally different. Grasping these distinctions can help investors, financial advisors, and everyday individuals create portfolios and plans that are not only aligned with their psychological comfort but also their financial reality. This article explores the nuanced differences between risk tolerance and risk capacity, incorporating practical examples, real cases, data-backed insights, and clear comparisons to guide more effective financial planning.

Illustration of the contrast between risk tolerance (emotional comfort with risk) and risk capacity (financial ability to bear risk), showing a thoughtful investor balancing feelings and financial data.

—

Defining the Key Concepts: Risk Tolerance and Risk Capacity

Risk tolerance refers to an individual’s emotional or psychological comfort with uncertainty and the possibility of financial loss. It is a subjective measure shaped by personal attitudes, life experiences, and temperament. For instance, some investors may feel comfortable riding out market downturns, while others might panic and sell prematurely. According to a 2023 Fidelity Investments survey, approximately 45% of retail investors identified themselves as “risk-averse,” indicating a low willingness to tolerate investment volatility.

In contrast, risk capacity measures an individual’s actual ability to withstand financial losses without jeopardizing their future financial goals. This is an objective assessment determined by factors such as income stability, net worth, time horizon, liquidity needs, and dependents. For example, a young professional with a stable job and no dependents has a higher risk capacity than a retiree relying on a fixed income.

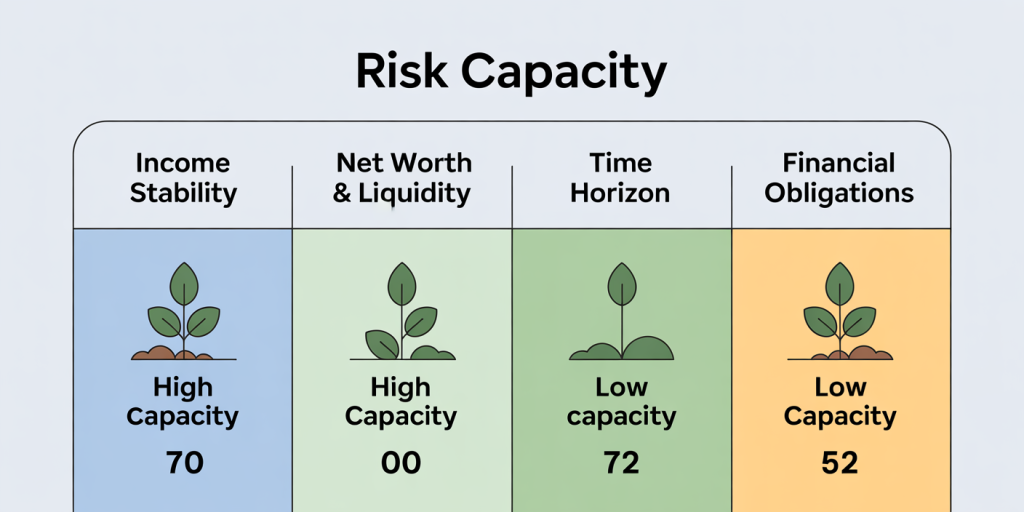

Infographic table visually summarizing key factors affecting risk capacity: income stability, net worth & liquidity, time horizon, and financial obligations, with icons representing high and low capacity scenarios.

Understanding these definitions is crucial because an investor’s risk tolerance might exceed their risk capacity, leading to potentially disastrous financial decisions, or vice versa, which might result in overly conservative investment strategies that inhibit growth.

—

Why Differentiating Risk Tolerance and Risk Capacity Matters

Individuals frequently confuse risk tolerance and risk capacity. The former relates primarily to emotions and psychology, while the latter is rooted in financial facts and life circumstances. When financial planning mixes these concepts indiscriminately, it can cause significant misalignment between what an investor feels comfortable with and what they can safely afford.

Consider a 35-year-old professional, Jane, who is emotionally comfortable taking aggressive investment risks. She expresses a high risk tolerance due to her optimistic outlook on markets and previous gains. However, Jane recently switched jobs and currently lacks a stable emergency fund, reducing her risk capacity significantly. If she invests heavily based on her risk tolerance alone, she may be forced to liquidate assets at a loss if an emergency arises.

Conversely, an individual with high risk capacity but low risk tolerance might play it overly safe, potentially resulting in lower returns and missed opportunities over the long term. A famous real-world scenario is the so-called “Lost Decade” for Japanese investors, many of whom stuck to ultra-conservative investments due to ingrained risk aversion despite having financial stability to assume more risk.

According to a 2022 Vanguard report, portfolio success is strongly correlated to accurate assessments of both risk tolerance and capacity. Portfolios designed without considering both lead to 15-20% higher chance of premature liquidations or underperformance.

—

Assessing Risk Tolerance: Psychological Tools and Behavioral Insights

Accurately gauging risk tolerance involves psychological evaluations and behavioral analysis. Financial advisors frequently use questionnaires that probe reactions to hypothetical market scenarios, preference for certainty, and past financial decision-making patterns. For example, the Risk Tolerance Questionnaire (RTQ) developed by the CFA Institute is a popular tool assessing key dimensions like willingness to lose money, need for financial security, and investment goals.

These assessments seek to identify behavioral biases as well, such as loss aversion—the tendency to feel losses more acutely than gains—versus risk-seeking behavior in the hope of outsized returns. Behavioral economists have documented that investors tend to make suboptimal decisions during market volatility due to emotional reactions, even if their stated risk tolerance is moderate.

To illustrate, the 2008 Global Financial Crisis tested investors’ true tolerance levels. A study from the Journal of Behavioral Finance observed that investors who self-reported moderate to high risk tolerance often sold off assets during downturns, contradicting their survey responses. Practical implication: advisors must blend psychological tools with observed behaviors for a more realistic evaluation.

—

Calculating Risk Capacity: Financial Health, Goals, and Time Horizon

While risk tolerance is primarily emotional, risk capacity stems from tangible financial conditions evaluated through data-driven metrics. Several key factors determine risk capacity:

1. Income Stability: Secure and predictable income sources increase risk capacity. For example, government employees with pensions generally have higher risk capacity than gig workers with fluctuating income streams.

2. Net Worth and Liquidity: A high net worth and easy access to cash reserves allow investors to absorb losses without immediate financial distress. The U.S. Federal Reserve’s 2023 Survey of Consumer Finances highlighted that households with liquid assets covering at least six months of expenses exhibited a 30% higher risk capacity.

3. Investment Time Horizon: Younger investors or those with plans decades away can tolerate more risk because they have time to recover from market downturns. In contrast, retirees or those nearing significant financial milestones generally require lower risk exposure.

4. Financial Obligations: Dependents, debt levels, and upcoming expenses can curb risk capacity by increasing financial pressure.

Risk capacity can be quantified by using financial models and stress-testing portfolios under adverse scenarios to ensure the investor can meet critical needs without forced asset sales.

To present this visually, the following table summarizes the major determinants of risk capacity:

| Factor | High Risk Capacity | Low Risk Capacity |

|---|---|---|

| Income Stability | Long-term, predictable salary or pension | Irregular, gig-based, or no income |

| Net Worth & Liquidity | Large savings & liquid assets | Minimal savings, illiquid assets |

| Time Horizon | >15 years | <5 years |

| Financial Obligations | None or manageable | Significant dependents or debt |

—

Balancing Risk Tolerance and Risk Capacity in Portfolio Construction

Financial advisors emphasize the importance of aligning investment strategies with both risk tolerance and risk capacity. These components should complement rather than contradict one another. Ignoring either can generate friction leading to either emotional distress or financial loss.

A practical example is the 55-year-old Mark, who feels uncomfortable with volatility (low risk tolerance) but has a stable pension and adequate retirement plan (high risk capacity). An optimal portfolio might focus on a balanced approach utilizing dividend-paying stocks and bond funds that reduce volatility while capitalizing on Mark’s financial stability.

Conversely, 28-year-old Sara has high risk tolerance, loves tech stocks, and has no dependents, but due to recent job loss, her income and liquidity have declined (low risk capacity). Despite her emotional predisposition, an advisor might recommend a cautious approach prioritizing rebuilding emergency funds before diving into aggressive investments.

Mutual funds, ETFs, and robo-advisors frequently use proprietary algorithms integrating both risk parameters to customize portfolios for investors. Modern investment platforms often ask detailed questions and analyze account data to ensure recommended portfolios are both suitable (in terms of capacity) and acceptable (in terms of tolerance).

—

Real Cases Demonstrating the Impact of Misalignment

Case Study 1: Overestimating Risk Capacity

John, a 40-year-old engineer, expressed moderate risk tolerance but had ill-defined savings, high credit card debt, and a mortgage with limited emergency reserves. Encouraged by a financial advisor, he invested 70% of his portfolio in equities. Unexpected medical expenses forced him to liquidate stocks during a market downturn, cementing losses and delaying retirement plans by several years.

This case highlights how overestimating risk capacity can lead to forced liquidation and compounded losses.

Case Study 2: Underestimating Risk Tolerance

Maria, retired at 65, has a secure pension and considerable savings, but her low comfort with price fluctuations led her to hold mainly cash and bonds, with returns barely exceeding inflation (1.5-2%). Over 15 years, inflation eroded her portfolio’s purchasing power significantly, requiring the use of social support programs.

This case demonstrates how underestimating risk tolerance and capacity can cause suboptimal wealth growth and compromise quality of life.

A survey published in the Journal of Financial Planning observed that nearly 40% of investors do not correctly balance these dimensions, underscoring the widespread importance of education and advisory support in this field.

—

Leveraging Technology and Data in Measuring Risk

Recent advancements in fintech and big data analytics have enhanced the precision and personalization of risk assessment. Artificial Intelligence (AI) models can now analyze thousands of data points—from transaction patterns and market conditions to psychological traits—to produce dynamic risk profiles.

For example, platforms like Betterment and Wealthfront incorporate machine learning algorithms that adjust portfolio recommendations as users’ financial situations or market environments evolve. This responsive approach helps in maintaining alignment between risk tolerance and capacity over time.

Moreover, wearable tech and sentiment analysis tools are being experimented with to capture real-time emotional states connected to financial decision-making, providing holistic risk profiling beyond static questionnaires.

—

Future Perspectives: Evolving Paradigms in Risk Assessment

As financial markets become more complex and personalized investing grows, understanding and integrating risk tolerance and risk capacity will remain vital. Future developments may include: Dynamic Risk Profiling: Continuous real-time adjustments to risk parameters based on life events, market volatility, and emotional cues. Behavioral Finance Integration: More sophisticated models combining psychological behavioral data with hard financial metrics to prevent decision-making errors. Regulatory Initiatives: Encouraging transparent disclosure and advisor accountability on risk assessments to protect investors from misaligned products. Holistic Financial Wellness Platforms: Combining health, financial, and emotional data to provide comprehensive advice for balancing risk and reward.

Futuristic depiction of AI-driven financial advising platforms using big data and behavioral analytics to dynamically assess and align investors’ risk tolerance and capacity in real time.

The growing awareness that “what you can handle” emotionally and “what you should” financially are distinct but interconnected will shape smarter investing strategies and more resilient portfolios in the years ahead.

—

By differentiating and correctly balancing risk tolerance and risk capacity, investors and advisors can create investment strategies that are not only sustainable but also psychologically comfortable, leading to better financial outcomes over the long term. Practical application, ongoing reassessment, and leveraging new technologies remain key to this evolving challenge in personal finance management.