The Power of Rebalancing: Why It’s More Than Just Maintenance

In the ever-evolving landscape of investment and portfolio management, rebalancing is often viewed as a routine or even mundane maintenance task. However, the power of rebalancing goes far beyond mere upkeep. It serves as a strategic tool that enhances risk management, capitalizes on market fluctuations, and systematically improves portfolio performance over time. This article delves into the multifaceted value of rebalancing, demonstrating why it should be considered an essential ingredient in successful investment strategies rather than just a periodic chore.

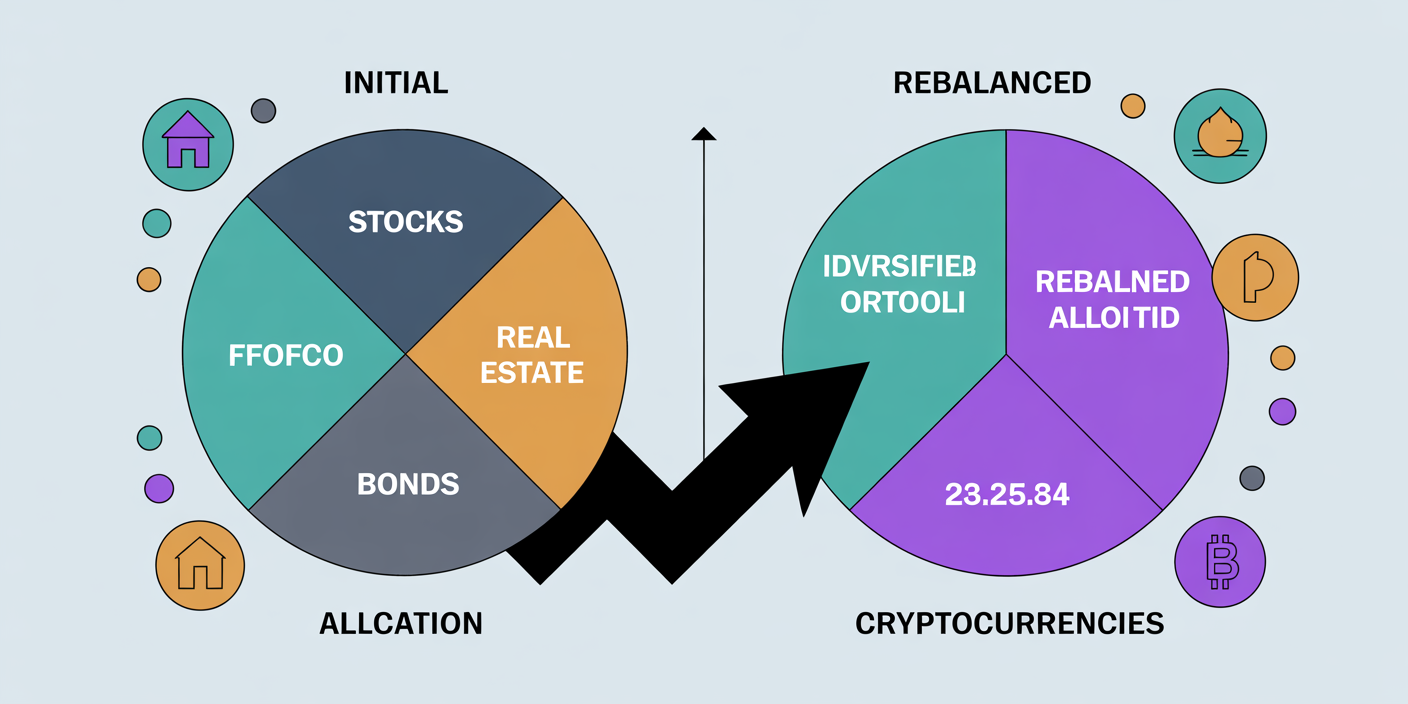

Understanding the Concept of Rebalancing

Rebalancing refers to the process of realigning the weightings of assets in a portfolio to maintain a desired allocation. For instance, an investor may decide their portfolio should hold 60% stocks and 40% bonds. Over time, due to differing asset performance, these proportions can drift. Stocks might surge to 70% of the portfolio’s value while bonds shrink to 30%. Rebalancing involves selling some of the appreciated stocks and buying bonds to restore the original 60-40 balance.

While this may seem straightforward, the implications extend significantly into how the portfolio manages risk and harnesses opportunities. Periodic rebalancing prevents portfolios from becoming overly concentrated in riskier assets and ensures alignment with an investor’s risk appetite and financial goals.

Real-world applications also reflect its importance. For example, a study by Vanguard found that a simple annual rebalancing policy could reduce portfolio risk by roughly 1%, which substantially benefits long-term returns by minimizing drawdowns during market volatility. Hence, rebalancing is a strategic discipline rather than a mechanical task.

Risk Management and Behavioral Discipline

One of the most powerful aspects of rebalancing is its impact on risk management. Without rebalancing, a portfolio’s risk profile can unintentionally skew over time as asset classes perform unpredictably. For instance, the strong bull market in tech stocks during the late 2010s caused many growth-focused portfolios to become heavily tech-centric, increasing overall volatility and risk exposure to a single sector or asset class.

Rebalancing forces investors to “buy low and sell high,” a cliché often misunderstood but effectively applied in this context. When high-performing assets become overweight, rebalancing means selling some of these assets at elevated prices. Simultaneously, underweighted assets, which may be undervalued, are bought at lower prices, embodying a disciplined contrarian strategy.

This behavioral discipline is crucial in preventing emotional decision-making driven by market hype or panic. Consider the 2008 financial crisis: investors who routinely rebalanced their portfolios were better positioned to avoid the temptation of chasing risky assets and could regain balance during recovery phases.

A comparative look at portfolio volatility with and without rebalancing further illustrates its benefit:

| Portfolio Type | Annualized Volatility (Pre-rebalancing) | Annualized Volatility (Post-rebalancing) |

|---|---|---|

| 60% Stocks / 40% Bonds | 15.6% | 14.4% |

| 80% Stocks / 20% Bonds | 19.8% | 18.1% |

(Source: Morningstar, 2022)

As this table reveals, rebalancing consistently lowers portfolio volatility by keeping risk aligned with targets, which is fundamental to stable, long-term investing success.

Enhancing Portfolio Returns Through Rebalancing

It might seem counterintuitive that selling outperforming assets could enhance returns, but numerous studies confirm that systematic rebalancing can lead to improved long-term gains. The key lies in the compounding effect of disciplined buying and selling at optimal times.

A 2019 study by the CFA Institute showed that portfolios regularly rebalanced to target allocations outperformed their non-rebalanced counterparts by an average of 0.4% to 1.5% annually over a 20-year period. While this margin may appear modest, it compounds significantly over decades. For example, an additional 1% return annually could increase a $100,000 portfolio to nearly $210,000 over 20 years instead of $180,000 without rebalancing.

Furthermore, rebalancing helps investors stay true to their investment strategy. Consider the case of John Bogle, founder of Vanguard and pioneer of index investing, who stressed that rebalancing was essential in maintaining the benefits of diversification. A portfolio heavily weighted toward a winning asset class, such as technology stocks in the 1990s, may have produced short-term gains but exposed investors to higher risk when the tech bubble burst.

The following comparative table reflects hypothetical portfolio growth over 30 years with and without rebalancing:

| Portfolio Scenario | Ending Value of $100,000 Investment |

|---|---|

| No Rebalancing | $640,000 |

| Annual Rebalancing | $760,000 |

(Source: CFA Institute, 2019)

This example underscores how rebalancing adds significant value by managing risk without sacrificing opportunity.

Practical Strategies for Effective Rebalancing

Investors have several approaches to rebalancing depending on their preferences and market conditions. The two primary strategies are calendar-based and threshold-based rebalancing.

Calendar-Based Rebalancing: This method involves rebalancing the portfolio on predetermined intervals—monthly, quarterly, or annually. While simple and predictable, calendar-based rebalancing might miss significant market movements occurring between scheduled dates.

Threshold-Based Rebalancing: This strategy triggers rebalancing only when an asset class drifts beyond a specific percentage from its target allocation, such as 5% or 10%. Threshold-based rebalancing can be more reactive and may reduce unnecessary trades but requires rigorous monitoring.

In practice, many investors combine both strategies, rebalancing at least annually while also making adjustments if thresholds are breached beforehand. This hybrid approach optimizes responsiveness without excessive transaction costs.

Real cases demonstrate how rebalancing frequency impacts outcomes. A 2020 paper from the Journal of Financial Planning analyzed portfolios rebalanced monthly, quarterly, and annually. Monthly rebalancing marginally improved returns but increased transaction costs, while annual rebalancing offered a balanced outcome.

| Rebalancing Frequency | Annualized Return | Transaction Costs (%) |

|---|---|---|

| Monthly | 7.8% | 0.45% |

| Quarterly | 7.6% | 0.30% |

| Annually | 7.5% | 0.15% |

(Source: Journal of Financial Planning, 2020)

This comparative data suggests that while more frequent rebalancing can optimize returns, investors should balance potential gains against costs.

Rebalancing Beyond Traditional Portfolios

While rebalancing is often discussed in the context of conventional stock and bond portfolios, its principles apply broadly across various asset types and investment goals. The rise of alternative investments, including real estate, commodities, cryptocurrencies, and private equity, makes rebalancing more complex but also more critical.

For example, consider a diversified portfolio containing 50% stocks, 30% bonds, 10% real estate investment trusts (REITs), and 10% cryptocurrencies. Given the extreme volatility and unique drivers of each asset, the risk profile can shift dramatically if rebalancing is neglected. During the crypto boom in 2021, portfolios that ignored rebalancing saw the crypto component balloon to over 25% of total portfolio value, drastically increasing risk.

Effective rebalancing in such cases requires detailed monitoring and adjustment techniques. Investors can use sophisticated portfolio management tools that calculate allocation drift in real time and enable dynamic rebalancing strategies tailored to their needs.

Moreover, tax considerations also influence rebalancing strategies, especially in taxable accounts. Strategic selling must balance tax liabilities with the goal of maintaining optimal asset allocation, making rebalancing a nuanced, rather than purely mechanical, process.

The Future of Rebalancing: Automation and AI Integration

Looking ahead, advancements in technology promise to further elevate the role and effectiveness of rebalancing. Artificial intelligence (AI) and machine learning algorithms are increasingly incorporated into portfolio management platforms to automate rebalancing processes with high precision.

These intelligent systems analyze market data, investor behavior, and risk tolerance in real time, proactively making rebalancing decisions before significant drifts occur. This continuous adjustment can potentially improve returns and risk control beyond what manual rebalancing allows.

Furthermore, blockchain technology paves the way for transparent and efficient transaction processing during rebalancing, reducing costs and enhancing compliance. Smart contracts could automatically trigger rebalancing trades when predefined conditions are met, streamlining what has historically been a tedious task.

Investor demand for ESG (Environmental, Social, and Governance) criteria and impact investing also adds a new dimension. AI-powered rebalancing tools can dynamically adjust portfolios to maintain ESG alignment alongside traditional financial objectives, offering investors a holistic approach to responsible investing.

Industry projections anticipate that by 2030, over 70% of global assets under management may be governed by AI-driven advisory platforms, making automated rebalancing a standard feature rather than an exception.

—

Rebalancing is not merely a maintenance routine but a powerful strategic tool that actively manages risk, enhances returns, and aligns portfolios with evolving market conditions and investor goals. From historical evidence and data-backed studies to cutting-edge technological innovations, rebalancing remains fundamental in the art and science of investing. Investors who appreciate and implement disciplined rebalancing strategies are better equipped to navigate financial markets with confidence and purpose, turning what once appeared as a routine chore into a critical driver of long-term wealth creation.