The Psychology of Investing: How to Manage Emotions in Bull and Bear Markets

Investing is as much a psychological challenge as it is a financial one. While understanding market trends, analyzing economic data, and choosing the right assets play crucial roles, the emotional and cognitive aspects of investing often drive decision-making—sometimes more powerfully than logic or strategy. This article explores the psychology behind investing and offers guidance on managing emotions during the highs of bull markets and the lows of bear markets. By integrating real-life examples, behavioral finance principles, and actionable strategies, investors can better navigate market fluctuations and improve long-term outcomes.

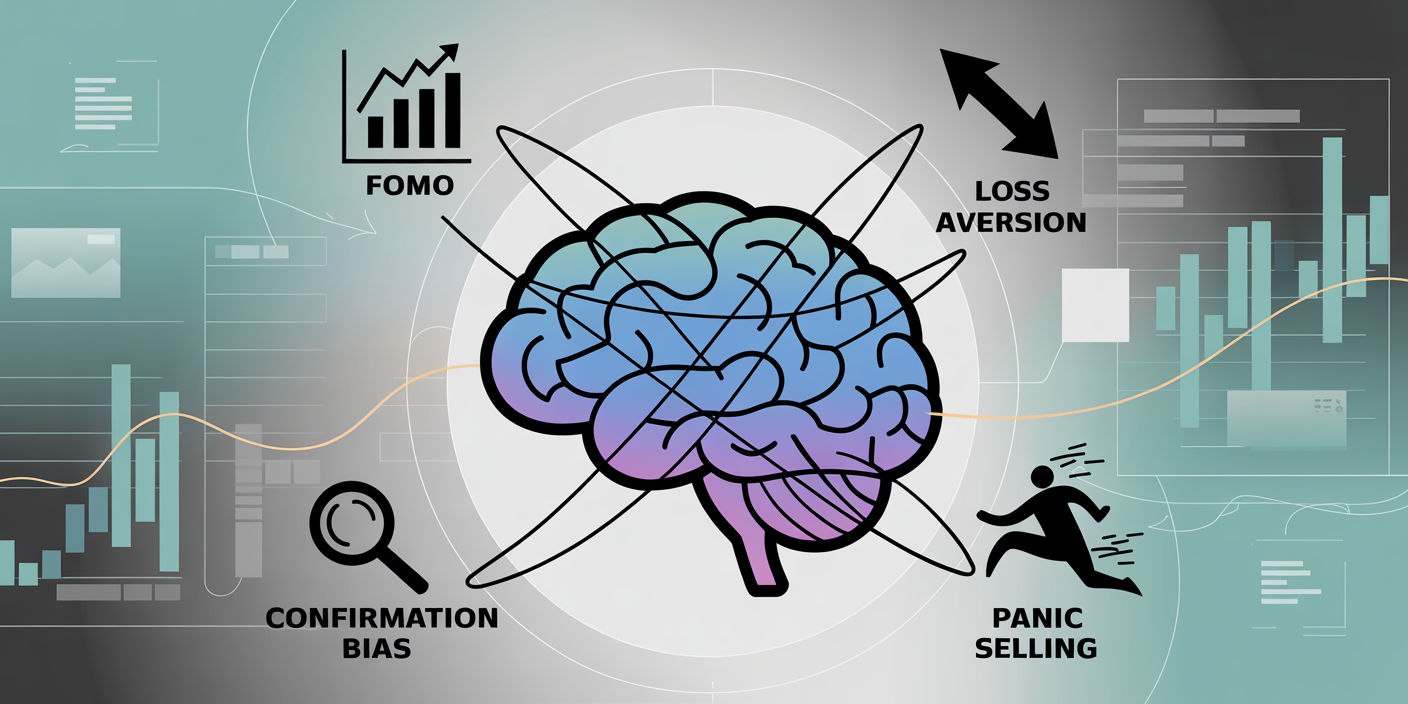

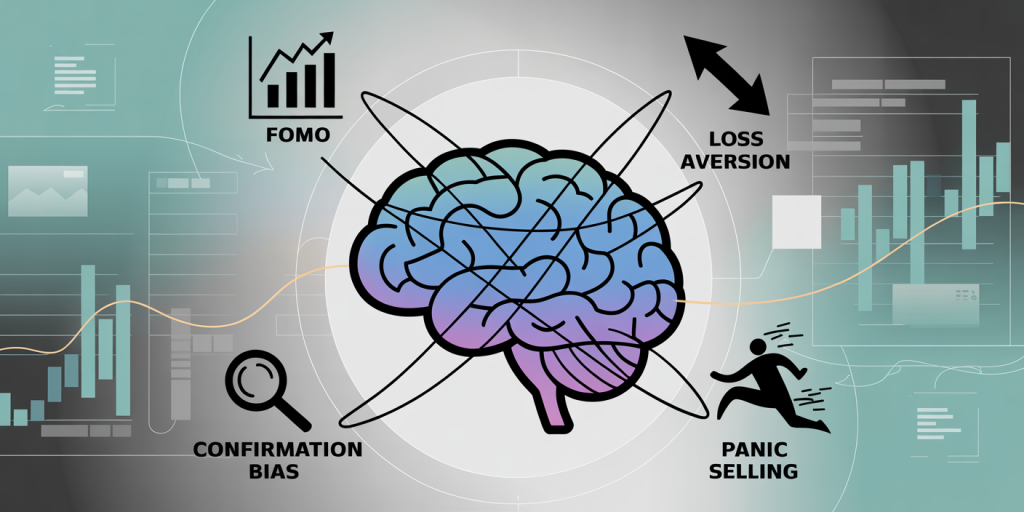

Emotional Dynamics in Bull and Bear Markets

Bull markets—characterized by sustained upward trends in stock prices—often inspire optimism and confidence among investors. Conversely, bear markets—marked by prolonged declines—can evoke fear, anxiety, and sometimes panic selling. These emotional responses are deeply embedded in human psychology and are influenced by cognitive biases, herd behavior, and risk perception.

During a bull market, investors tend to experience the “fear of missing out” (FOMO). The price appreciation of assets and success stories of peers create a contagion of enthusiasm, often leading to overconfidence and riskier investment choices. For example, during the dot-com bubble of the late 1990s, many investors poured money into technology stocks without adequate due diligence, fueled by the excitement of soaring valuations. This exuberance eventually led to widespread losses when the bubble burst.

In contrast, bear markets trigger loss aversion—a psychological tendency to prefer avoiding losses over acquiring comparable gains. Research by Kahneman and Tversky highlights that losses hurt approximately twice as much psychologically as gains please us. This loss aversion leads investors to sell off holdings at market bottoms, locking in losses rather than waiting for recovery. For instance, during the 2008 financial crisis, approximately 18% of investors exited the stock market near the bottom, missing out on subsequent rallies (Dalbar Inc., 2019).

Table 1: Emotional Tendencies and Cognitive Biases in Bull vs. Bear Markets

| Aspect | Bull Market | Bear Market |

|---|---|---|

| Dominant Emotion | Optimism / Overconfidence | Fear / Anxiety |

| Common Biases | FOMO, Confirmation bias | Loss aversion, Panic selling |

| Typical Behavior | Buying aggressively, risk-taking | Selling hastily, risk aversion |

| Market Example | Dot-com bubble (1999-2000) | 2008 Global Financial Crisis |

Understanding these emotional dynamics is crucial for investors to avoid impulsive decisions that can erode wealth.

Cognitive Biases that Influence Investment Behavior

Investors are often unaware of the cognitive biases shaping their investment decisions. These biases can distort judgment and lead to systematic errors.

One of the most prevalent is confirmation bias, where investors favor information that supports their existing beliefs while disregarding contradictory evidence. During bull markets, this bias reinforces optimism. For example, a 2020 survey by the CFA Institute found that 65% of investors around the world admitted to seeking news and analysis aligning with their market outlook.

Anchoring is another bias, where investors rely too heavily on an initial piece of information, such as a stock’s past price, when making decisions. In volatile markets, anchoring can prevent investors from adapting to new data, causing delayed reactions.

Recency bias leads investors to overweight recent market events in decision-making. In a bull market, strong recent gains may blind investors to signs of an impending downturn. Conversely, during a bear market, recent losses may lead to overly pessimistic views.

Emotional decision-making often overrides rational analysis because the brain’s limbic system—the seat of emotion—processes threats and rewards faster than the neocortex, responsible for logical reasoning. This neuropsychological interplay explains why fear and greed can dictate market cycles.

Practical Strategies for Emotional Discipline in Investing

Managing emotions in investing requires deliberate strategies that reinforce rational behavior and mitigate the impact of biases.

Diversification and Asset Allocation

One fundamental approach is maintaining a diversified portfolio across different asset classes—stocks, bonds, commodities, and alternatives. Diversification helps reduce overall portfolio volatility and psychological stress during market downturns, enabling investors to stay invested. For instance, during the COVID-19 pandemic stock sell-off in early 2020, investors with diversified portfolios experienced smaller drawdowns compared to purely equity-oriented portfolios.

Moreover, strategic asset allocation aligned with one’s risk profile and financial goals fosters emotional discipline. Tools like target-date funds or robo-advisors use algorithms to rebalance portfolios automatically, minimizing behavioral pitfalls.

Setting Clear Investment Goals

Having clearly defined investment objectives, such as retirement, education funding, or home purchase, helps anchor decisions in long-term priorities rather than short-term market noise. Behavioral economists emphasize the importance of goal-based investing in reducing impulsive reactions.

Investors should also establish predetermined rules, such as stop-loss orders or systematic rebalancing schedules. These rules serve as external controls to avoid knee-jerk reactions caused by emotional surges. For example, a 2017 study by the University of Cambridge showed that investors using disciplined rebalancing had 20% higher net returns over 10 years compared to those who traded based on gut feelings.

Case Studies Demonstrating Emotional Impact on Investment Outcomes

Analyzing historical cases provides deeper insights into how emotions influence investment behavior—and how disciplined approaches can pay off.

The 2008 Financial Crisis and Panic Selling

During the 2008 crisis, many retail investors succumbed to widespread panic selling. Vanguard’s data reveals that investors who sold equity mutual funds at the market bottom in March 2009 faced a median loss of nearly 30% compared to those who stayed invested. Conversely, those who maintained or added to positions recovered losses within three years and outperformed the market during the subsequent bull run.

This case underscores how fear-induced decisions can be detrimental. It also highlights the value of calm, informed decision-making supported by an understanding of market cycles.

The 1999-2000 Dot-Com Bubble Burst

Investors driven by hype bought technology stocks at inflated prices without considering fundamentals. When the bubble collapsed, many suffered heavy losses. However, investors who focused on valuation metrics and diversified their holdings experienced less impact.

This event illustrates the danger of herd behavior and overconfidence during bull markets. Developing skepticism and sticking to investment principles can guard against such pitfalls.

Table 2: Emotional Behavior and Outcomes in Historical Market Events

| Market Event | Emotional Response | Typical Investor Action | Outcome for Impulsive Investors | Outcome for Disciplined Investors |

|---|---|---|---|---|

| Dot-Com Bubble (1999-2000) | Overconfidence / FOMO | Buying high, chasing hype | Significant losses | Preserved capital, less volatility |

| 2008 Financial Crisis | Fear / Panic selling | Selling near market bottom | Realized steep losses | Recovered losses, captured gains |

| COVID-19 Market Drop (2020) | Anxiety / Uncertainty | Selling or holding cash | Missed rapid rebound | Benefited from swift recovery |

The Role of Mindfulness and Emotional Awareness

Psychological resilience can be strengthened through mindfulness—an approach involving awareness and acceptance of current emotions without impulsive reaction.

Mindfulness training for investors includes techniques like journaling investment decisions, reflecting on emotional triggers, and practicing controlled breathing to reduce stress. A 2021 study published in the Journal of Behavioral Finance found that investors practicing mindfulness were 30% less likely to engage in panic selling during market volatility.

By cultivating emotional awareness, investors can recognize fear or greed as they arise and objectively assess situations before making decisions. This practice promotes patience and adherence to investment plans, especially in turbulent markets.

Future Perspectives: Behavioral Finance and Technology Integration

The evolving field of behavioral finance continues to shed light on the intricate relationship between emotions and investment outcomes. Recent advances in neuroscience, along with large-scale data analytics, enable deeper understanding of investor psychology. This knowledge is increasingly integrated into fintech innovations designed to assist investors.

Robo-advisors and AI-driven platforms now include behavioral coaching features that detect emotional biases and offer real-time guidance. For example, some platforms alert users when their trading patterns indicate excessive risk-taking or panic selling, recommending pauses or alternative strategies.

Furthermore, virtual reality (VR) and gamification tools are emerging for financial education, allowing investors to simulate market environments and build emotional endurance before risking real capital.

As global markets grow more complex and interconnected, emotional management will remain a cornerstone of successful investing. Continuous learning and adaptive strategies, supported by technological tools, will empower investors to better navigate future bull and bear markets.

Final Thoughts

The psychology of investing reveals why many investors struggle not with market fundamentals, but with managing their own emotions. Recognizing common cognitive biases and emotional responses during bull and bear markets is the first step toward greater discipline. Combining practical strategies such as diversification, goal-setting, and mindfulness with emerging technologies can reduce costly mistakes driven by fear and greed.

Ultimately, investing is a test of both intellect and character. Investors who master their emotions stand to achieve superior financial outcomes and long-term peace of mind. Success is not just about timing the market, but cultivating the emotional resilience to withstand its inevitable ups and downs.