The Role of Cash in an Investment Portfolio (and When to Use It)

In the dynamic world of investing, the allocation of assets is a critical component of portfolio management. While stocks, bonds, real estate, and alternative investments often dominate conversations about growth and income potential, cash remains a fundamental, yet sometimes overlooked, element of a well-rounded investment portfolio. Beyond simply being “money in the bank,” cash serves multiple roles that can optimize an investor’s strategy, protect against volatility, and provide liquidity when opportunities arise.

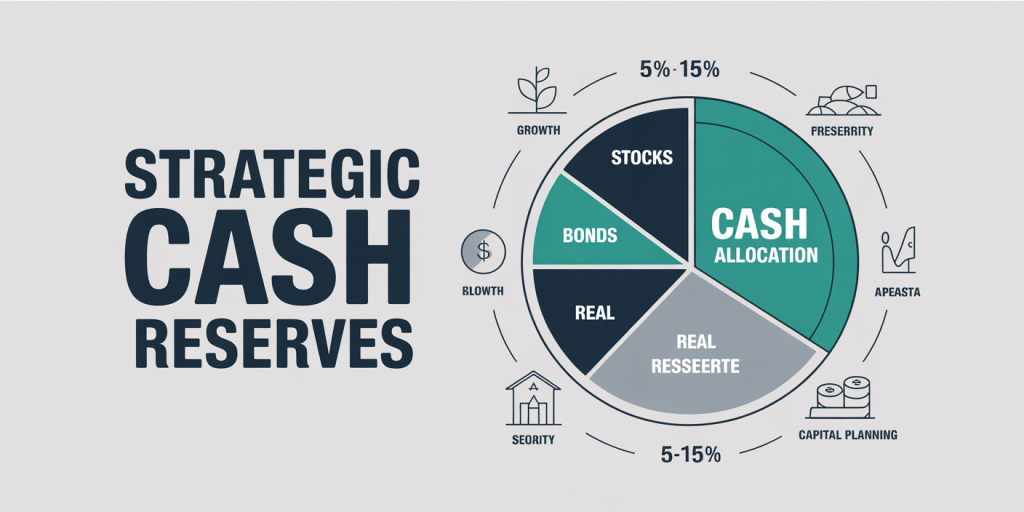

Illustration of a diversified investment portfolio pie chart highlighting the cash allocation segment (5%-15%) alongside stocks, bonds, and real estate, emphasizing liquidity and capital preservation.

The presence of cash in an investment portfolio is often debated. Some investors view it as a safety net that cushions against market downturns, while others see it as an underperforming asset that drags on overall returns. Understanding the strategic purpose cash serves and identifying scenarios in which holding cash can be most advantageous is essential for both individual and institutional investors. This article delves into the roles cash plays within a portfolio, supported by real-world examples, data, and practical advice on when and how to use cash effectively.

The Strategic Role of Cash in Portfolio Allocation

Cash typically refers to highly liquid assets—cash itself, money market funds, short-term Treasury bills, and other equivalents—that can be quickly converted into spending power without incurring significant losses. In portfolio construction, cash’s primary role is to provide stability and liquidity.

Holding cash allows investors to manage market risk, particularly during periods of high volatility. For example, during the 2008 global financial crisis, investors who maintained a cash reserve had the flexibility to avoid forced selling at depressed prices. According to the Investment Company Institute, money market fund holdings surged from $2.6 trillion in 2007 to over $3.4 trillion in early 2009, reflecting increased cash holdings as a risk aversion measure.

Moreover, cash serves as a ready source of funds for new investment opportunities. When markets become attractive due to price corrections or emerging sector trends, having cash on hand enables swift capital allocation without needing to liquidate existing positions under unfavorable conditions.

Tactical deployment of cash concept: an investor strategically buying assets during market dips, with imagery of cash ready to be invested alongside icons of discounted stocks, real estate, and emerging sector opportunities.

In a typical balanced portfolio designed for moderate growth, cash allocations usually range between 5% to 15%. This range balances the need for liquidity and capital preservation against the opportunity cost of holding low-yielding assets. Institutional investors may maintain lower cash percentages due to larger capital bases and access to credit lines, but individual investors often benefit from higher cash reserves for flexibility and emergency needs.

Cash as a Defensive Asset in Volatile Markets

Market volatility is a defining characteristic of modern investing, with risks stemming from geopolitical uncertainty, economic cycles, and unexpected events such as pandemics. During turbulent periods, cash acts as a defensive asset, preserving capital when equity and bond markets are under pressure.

Visual representation of cash as a defensive asset during market volatility, showing a stock market graph plunging (e.g., 2020 COVID-19 crash) with a protective shield symbolizing cash preserving capital and enabling opportunity.

A clear example occurred during the onset of the COVID-19 pandemic in early 2020. From February to March 2020, the S&P 500 plummeted nearly 34%, wiping out trillions of dollars in market value. Investors holding meaningful cash allocations were insulated from this drawdown and positioned to deploy capital during the subsequent market rebound. Data from Morningstar shows that money market funds saw an inflow of nearly $90 billion in March 2020, illustrating investors’ increased preference for liquidity during uncertainty.

Cash’s safety comes with the trade-off of minimal returns, especially in low-interest-rate environments. For instance, from 2020 to 2023, Federal Reserve policy kept interest rates near zero, resulting in money market yields often below 0.5%. Despite this, the role of cash in reducing portfolio drawdowns can justify its inclusion, especially for risk-averse investors or those nearing retirement.

Practical asset allocation models often recommend increasing cash holdings ahead of anticipated market corrections. For example, Warren Buffett’s Berkshire Hathaway held more than $140 billion in cash during parts of 2020 and 2021, enabling substantial investments such as buying shares of Occidental Petroleum on attractive terms when energy stocks fell.

Cash for Tactical Opportunity and Market Timing

While long-term investing prioritizes disciplined contributions and buy-and-hold strategies, the tactical use of cash enables active investors to capitalize on market inefficiencies and unique opportunities. Having available cash can enable investors to “buy the dip,” participate in initial public offerings (IPOs), or invest in undervalued sectors.

Consider the real estate sector’s correction after the 2007-2008 crisis. Investors with cash reserves acquired distressed properties or Real Estate Investment Trusts (REITs) at heavily discounted prices, resulting in outsized gains during the recovery. According to NAREIT data, REIT indices fell by more than 50% during the downturn but recovered robustly, with investors entering at lows benefiting significantly.

Similarly, during tech sector pullbacks, cash enables investing in innovative companies with high growth potential but short-term volatility. For example, investors with cash reserves in early 2022 could purchase technology stocks after a steep correction driven by inflation concerns and rising interest rates.

The key challenge lies in timing — cash positions are effective only if deployed judiciously. Passive investors often risk underperformance if cash holdings remain high during bull markets, missing out on compounding growth. Therefore, a balanced approach involves maintaining a sufficient cash buffer while periodically assessing market valuations to optimize deployment.

Table 1: Hypothetical Impact of Cash Deployment in Market Corrections

| Scenario | Initial Cash Holding | Market Dip (%) | Investment Return Post-Dip (%) | Overall Portfolio Impact (%) |

|---|---|---|---|---|

| No Cash, Fully Invested | 0% | -30% | +50% | +5% |

| 10% Cash, Deployed After Dip | 10% | -30% | +50% (on cash portion) | +12% |

| 20% Cash, Deployed After Dip | 20% | -30% | +50% (on cash portion) | +19% |

*Source: Hypothetical illustrative example created by author.*

This simplified scenario underlines the potential additive effect of maintaining cash and deploying it strategically.

Cash as a Tool for Income and Capital Preservation

While cash typically does not provide significant income compared to bonds or dividend-paying stocks, it plays a vital role in capital preservation—an especially important consideration for conservative or income-focused investors.

In fixed-income portfolios, cash helps manage interest rate risk by maintaining liquidity and reducing duration exposure. Short-term Treasury bills and money market funds that constitute cash equivalents offer principal protection and low credit risk. This stability contrasts sharply with bond funds exposed to longer maturities, which can suffer sudden price declines when interest rates rise.

For retirees or income-seeking investors, cash provides stability to meet regular spending needs without forcing the sale of higher-risk assets at inopportune times. For example, a retiree might maintain 6 to 12 months’ worth of expenses in cash or equivalents within their portfolio to cover draws, reducing the risk of selling equities during downturns and potentially locking in losses.

Data from the Federal Reserve’s Survey of Consumer Finances indicates that households in the oldest age cohorts tend to hold approximately 15% to 20% of financial assets in cash or cash-like instruments for this purpose.

When to Use Cash: Timing and Triggers

Effectively using cash requires understanding when to increase cash holdings and when to deploy cash into investments. Several practical guidelines and triggers help investors decide:

1. Market Overvaluation: Periods of extreme market valuation provide signals to increase cash allocations. Metrics such as the cyclically adjusted price-to-earnings (CAPE) ratio can signal overvaluation. Historically, elevated CAPE levels presaged lower future returns, suggesting defensive cash positions make sense. For example, the CAPE ratio exceeded 30 during the dot-com bubble in 2000 and again in 2021, coinciding with elevated market risk.

2. Personal Financial Needs: Investors anticipating large expenses—home purchases, education costs, or emergency needs—should hold cash to avoid forced asset liquidation.

3. Tactical Opportunities: When valuations pull back abruptly, investors can deploy accumulated cash to optimize entry points, as seen during the 2020 pandemic market dip or the 2009 recovery following the financial crisis.

4. Market Uncertainty and Liquidity Preference: Heightened geopolitical risk or economic uncertainty often motivates increased cash weights to preserve capital, exemplified during the early months of the COVID-19 crisis.

In one illustrative case, the AAA-rated pension fund CalPERS strategically increased cash holdings to approximately 8% in early 2020 to navigate anticipated volatility. This proved effective as it avoided forced asset sales and enabled opportunistic purchases once markets stabilized.

Comparative Overview: Cash vs. Other Liquid Assets

Although cash is often equated with liquidity, other instruments like short-term bonds or ultra-short bond funds also offer liquidity with varying degrees of return potential and risk profiles. The table below outlines a comparative analysis:

| Asset Type | Liquidity | Yield (2023 Avg.) | Risk Level | Suitability |

|---|---|---|---|---|

| Cash (Checking/Savings) | Instant | 0.01% – 0.5% | Minimal (FDIC insured) | Emergency funds, Short-term needs |

| Money Market Funds | Same day | 0.5% – 2.5% | Very Low | Cash equivalents, portfolio buffer |

| Treasury Bills (<1 yr) | 1-2 days | 1.5% – 4.5% | Low (Government backed) | Capital preservation, laddering |

| Ultra-short Bond Funds | 1-3 days | 3% – 5% | Low to Moderate | Slightly higher income, some interest risk |

*Sources: U.S. Treasury, ICI, Morningstar (2023)*

Investors must weigh the yield against liquidity and risk. In low-rate environments, money market funds and short-term Treasuries often serve as superior alternatives for cash allocation.

Looking Ahead: The Future of Cash in Investment Portfolios

The role of cash in investment portfolios is evolving alongside changing financial landscapes. Rising interest rates since 2022 have increased the attractiveness of cash and cash equivalents as yield providers rather than purely safe havens. High inflation and geopolitical tensions favor portfolio resilience, placing greater emphasis on cash’s defensive and tactical roles.

Technology and fintech innovations are also transforming how investors manage cash, with digital platforms offering higher-yielding cash management accounts integrated directly into brokerage portfolios. This enhances accessibility and tactical flexibility for retail investors.

Additionally, the growing interest in liquid alternatives and flexible asset classes may complement or partially substitute traditional cash holdings. However, the fundamental principles—liquidity, capital preservation, and opportunity readiness—remain intrinsic to cash’s role.

In portfolio construction, forward-looking investors will increasingly integrate cash management strategies using real-time data and predictive analytics to optimize deployment timing based on macroeconomic indicators and market sentiment.

A strategic cash allocation will continue to be a cornerstone of prudent portfolio management, especially as volatility and economic uncertainty persist. Balancing cash with growth-oriented assets will ensure that portfolios remain resilient and agile in the face of future challenges and opportunities.

—

In sum, cash is far more than a low-yielding placeholder in an investment portfolio. Its strategic use for risk management, capital preservation, and tactical investment opportunity offers investors both protection and flexibility. Understanding when and how to use cash effectively can improve portfolio outcomes and empower investors to navigate financial markets with confidence.