Understanding Tax-Efficient Investing: Keep More of What You Earn

Tax-efficient investing is a strategic approach to managing investment portfolios that focuses on minimizing tax liabilities. As tax laws become increasingly complex, understanding how to invest in a tax-smart manner is essential for maximizing after-tax returns. Whether you are an individual investor or a financial advisor, recognizing the impact taxes have on your investments can lead to substantial savings and more wealth accumulation over time.

In this article, you will learn the fundamental concepts behind tax-efficient investing, practical strategies to implement it, and real-life examples demonstrating its significance. By adopting these techniques, investors can ensure they retain more of the income generated from their savings and investments.

—

The Basics of Tax-Efficient Investing

Tax-efficient investing is the process of selecting and managing investments in ways that minimize tax exposure, thus enhancing net returns. Taxes can affect nearly every type of investment income—dividends, interest, capital gains, and even real estate rents. The goal is to ensure that the impact of taxes is reduced without compromising the potential for growth.

For instance, consider two investors who both earn a 7% annual return. If one investor’s portfolio incurs a 30% tax rate on distributions and gains, while the other’s is subject to only 15%, the difference in retained earnings over time is significant. For a $100,000 portfolio, the lower tax burden over 20 years could translate into tens of thousands of dollars more in the account balance.

Tax-efficiency is not just about paying fewer taxes; it’s about smart planning. This includes choosing the right types of accounts, asset allocation aligned with tax implications, and tactical decisions on when to realize gains or losses.

—

Tax-Advantaged Accounts: The Foundation of Smart Investing

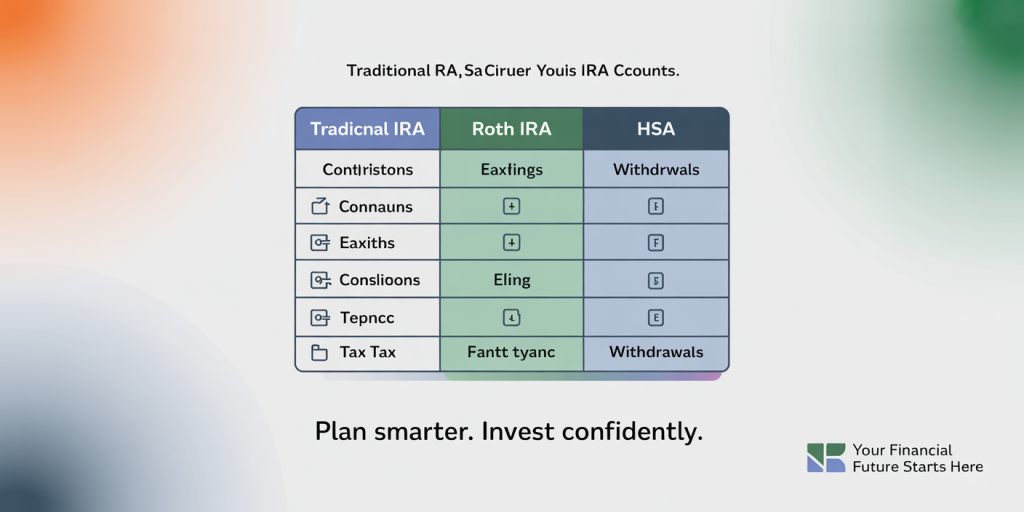

One of the most straightforward ways to increase tax-efficiency is by utilizing tax-advantaged accounts. These accounts provide tax breaks that can shield your investments from current or future taxation. The most common types include Individual Retirement Accounts (IRAs), 401(k)s, Roth IRAs, and Health Savings Accounts (HSAs).

Traditional IRAs and 401(k) plans allow you to defer taxes on contributions and investment growth until withdrawals during retirement. This deferral can lead to more substantial compounding because taxes do not reduce your earnings annually. Roth IRAs, on the other hand, offer tax-free withdrawals after meeting certain criteria since contributions are made with after-tax income. This makes future earnings and distributions tax-free.

A practical example is the Roth IRA advantage for young investors: Suppose you contribute $6,000 annually for 30 years to a Roth IRA, earning an 8% yearly return. Your contributions will have grown to approximately $797,000 tax-free, ready for withdrawal in retirement without owing a dime in taxes.

| Account Type | Tax Treatment on Contributions | Tax Treatment on Earnings | Taxes on Withdrawals |

|---|---|---|---|

| Traditional IRA/401(k) | Tax-deferred | Tax-deferred | Ordinary income tax |

| Roth IRA | After-tax | Tax-free | Tax-free (subject to conditions) |

| HSA | Tax-deductible | Tax-free | Tax-free if used for health expenses |

Using tax-advantaged accounts efficiently requires understanding the rules, such as contribution limits and withdrawal penalties, but the benefits can be substantial.

Asset Location Strategies: Positioning Investments Wisely

Asset location involves placing different types of investments into accounts that minimize tax impact. Different assets generate otherwise taxable income and gains, so understanding where to hold them matters.

High-yield bonds and taxable bonds, which generate regular interest taxed at ordinary income rates, are better situated in tax-deferred or tax-free accounts. Conversely, equities that benefit from long-term capital gains and qualified dividend rates, usually taxed more favorably, can remain in taxable accounts.

For example, imagine you have a portfolio split evenly between bonds yielding 4% interest and stocks expected to appreciate 7% per year with dividends. If you held bonds in a taxable account, you might lose 35% of the interest to taxes annually, versus zero in a tax-deferred account. In contrast, placing stocks in a taxable account allows you to pay only 15% on qualified dividends and long-term capital gains when you sell.

| Asset Type | Tax Rate on Interest/Dividends | Preferred Account Type |

|---|---|---|

| Taxable Bonds | Ordinary income (22-35%+) | Tax-deferred or tax-free |

| Municipal Bonds | Generally tax-exempt | Taxable accounts (if income is low) |

| Stocks (dividends, gains) | Qualified dividends: 0-20%, capital gains: 0-20% | Taxable accounts |

A real case from Morningstar research (2023) reveals that investors who implement asset location strategies increase their portfolio efficiency by an average of 1% to 1.5% per year. Over decades, this translates into substantial additional returns.

Tax-Loss Harvesting: Turning Losses Into Gains

Tax-loss harvesting is a tactical strategy used to reduce current taxes by selling investments that are at a loss, thus offsetting taxable gains realized from other sales. This approach is particularly effective in volatile markets where portfolio values fluctuate frequently.

For example, if an investor sells a different stock to realize $10,000 in gains, they may simultaneously sell a $7,000 losing stock to reduce their taxable gains. The net taxable gain becomes $3,000 rather than $10,000. This directly lowers the tax bill owed on capital gains.

The IRS allows up to $3,000 of net capital losses per year to be deducted against ordinary income, and losses exceeding this amount can be carried forward indefinitely. Investors should avoid the “wash sale” rule, which disallows a loss if the same or substantially identical security is repurchased within 30 days.

Practical benefits of tax-loss harvesting are highlighted in a JPMorgan Asset Management report indicating that disciplined harvesting can boost after-tax portfolio returns by approximately 0.5% to 1% annually. This enhancement may sound small but is significant over long investment horizons.

—

Understanding Capital Gains Taxes: Timing is Everything

Capital gains taxes are levied on the profit realized from the sale of assets and are categorized as short-term or long-term based on the holding period. Short-term gains—investments held one year or less—are taxed at ordinary income tax rates, which can be as high as 37%. Long-term capital gains, held over a year, enjoy lower rates ranging from 0% to 20%, depending on income levels.

The timing of asset sales affects taxes dramatically. For example, an investor in the 24% federal income tax bracket could pay 24% tax on short-term gains but only 15% on long-term gains. Selling after holding an asset for more than a year reduces taxable income significantly.

Suppose you sold $20,000 worth of appreciated stock. Under short-term capital gains, you might owe $4,800 (24%), whereas under long-term gains, you’d owe $3,000 (15%). The $1,800 difference saved could be reinvested to compound further.

| Holding Period | Tax Rate Range on Gains | Impact on After-Tax Return |

|---|---|---|

| 1 year or less (short-term) | 10% to 37% (ordinary income tax rate) | Higher tax reduces returns |

| More than 1 year (long-term) | 0%, 15%, or 20% depending on income | Lower tax enhances returns |

Therefore, patience in holding investments can be a powerful tool in tax-efficient investing.

—

The Role of Municipal Bonds and Tax-Exempt Investments

Municipal bonds (munis) are debt securities issued by states and municipalities. Their appeal lies primarily in their tax-exempt status; most munis are exempt from federal income tax, and some are also exempt from state taxes for residents.

For investors in high tax brackets, these bonds provide attractive after-tax yields compared to taxable bonds. For example, a muni bond offering a 3.5% yield might outperform a taxable government bond with a 5% yield once taxes are considered.

Data from the Municipal Securities Rulemaking Board (MSRB) in 2023 showed that about 40% of individual bond investors in the U.S. hold municipal bonds, largely due to their tax benefits.

Here’s a simplified illustration comparing taxable bond yields to muni yields at various tax brackets:

| Tax Bracket | Taxable Bond Yield | Taxable Equivalent Yield of Muni Bond (3.5% yield) |

|---|---|---|

| 22% | 4.5% | 4.5% |

| 35% | 5.4% | 5.4% |

| 37% | 5.6% | 5.6% |

The taxable equivalent yield formula is: \[ \text{Taxable Equivalent Yield} = \frac{\text{Muni Yield}}{1 – \text{Tax Rate}} \]

For example, an investor in a 37% bracket would need to find a taxable bond yielding approximately 5.6% to match a 3.5% tax-free muni bond.

Investors should consider munis in the fixed income portion of their portfolios if they live in states with high income tax rates or have high federal tax liability.

—

Future Perspectives: The Evolving Landscape of Tax-Efficient Investing

Tax laws and financial markets are continuously evolving, making the practice of tax-efficient investing an ongoing challenge and opportunity. Recently, proposals by policymakers in various countries aim to modify capital gains tax rates, tax loopholes, and retirement account rules. Staying informed is critical for timely adjustments.

Technology is enhancing investors’ and advisors’ capabilities to implement tax-efficient strategies. Sophisticated portfolio management software now integrates tax-loss harvesting, asset location optimization, and scenario modeling, allowing for personalized tax strategies.

Moreover, the rise of Environmental, Social, and Governance (ESG) investing and thematic portfolios requires further tax considerations as these investments may have different income generation patterns.

Data from Vanguard (2024) estimates that investors who actively engage in tax-efficient investing strategies see an average boost in after-tax returns of 0.5% to 2% annually—an important figure in an environment of low nominal returns.

Investors should regularly consult tax professionals and consider tax implications as part of their holistic financial planning. Incorporating future tax regulation changes, inflation, and income needs into your investment decisions will ensure you keep more of what you earn in an increasingly complex environment.

—

Tax-efficient investing is a powerful approach to enhancing net returns and achieving long-term financial goals. Through the smart use of tax-advantaged accounts, asset location, tax-loss harvesting, and an understanding of capital gains tax timing and municipal bonds, investors can meaningfully improve the efficiency of their portfolios. Staying aware of upcoming tax changes and leveraging technological tools will also position investors to optimize after-tax wealth accumulation continually. Ultimately, tax-efficient investing empowers you to keep more of what you earn and build a more prosperous financial future.