What Is a Custodial Account and How to Start Investing for Your Kids

When it comes to securing a child’s financial future, many parents and guardians look for smart investment options that can grow wealth over time. One such vehicle gaining momentum is the custodial account. This powerful financial tool allows adults to invest and manage assets on behalf of minors until they reach the age of majority, providing an impactful way to teach financial literacy and establish early wealth. In this article, we will delve into what a custodial account is, explore its benefits and limitations, and provide step-by-step guidance on how to start investing for your kids effectively.

Understanding Custodial Accounts: Key Concepts and Benefits

A custodial account is a financial account created for a minor under the management of a custodian, typically a parent or guardian. The custodian controls the account until the child reaches legal adulthood — usually 18 or 21 years old, depending on state laws. The most common custodial accounts are UTMA (Uniform Transfers to Minors Act) and UGMA (Uniform Gifts to Minors Act) accounts. Both allow adults to gift money or assets to a minor without the need for a formal trust.

Unlike traditional savings accounts, custodial accounts can hold a wide range of investments such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). This gives the child the potential to benefit from market growth over years or decades. According to a 2023 report by the Securities Industry and Financial Markets Association (SIFMA), custodial accounts have seen a 15% growth year-over-year, illustrating their rising popularity among millennial parents seeking to build generational wealth.

The appeal of custodial accounts lies in their simplicity and tax advantages. Gains up to a certain threshold are usually taxed at the child’s lower tax rate, which can result in significant tax savings compared to investing under the adult’s name. For example, the “kiddie tax” allows children to earn up to $2,500 tax-free in unearned income in 2024. Furthermore, custodial accounts require less paperwork and lower fees than establishing formal trusts, making them accessible entry points for long-term investment.

How Custodial Accounts Differ from Other Investment Accounts for Kids

Many families wonder how custodial accounts stack up compared to other popular financial options intended for kids, such as 529 college savings plans, traditional savings accounts, and trusts. Understanding these differences helps make informed decisions tailored to your family’s priorities.

| Feature | Custodial Account (UTMA/UGMA) | 529 College Savings Plan | Savings Account | Trust Account |

|---|---|---|---|---|

| Investment Options | Stocks, bonds, mutual funds, ETFs | Mutual funds, ETFs, state-specific investment options | Cash deposits only | Customized by attorney |

| Purpose | Broad use (education, expenses, gifts) | Specifically for qualified education expenses | General savings | Flexible, estate planning |

| Ownership | Child owns assets upon reaching legal age | Owned by adult; beneficiary named child | Owned and controlled by adult | Managed per trust terms |

| Tax Benefits | Taxed at child’s rate; kiddie tax applies | Earnings grow tax-free if used for education | Interest taxed as income | Depends on trust structure |

| Control After Minority | Transfers fully to child at age of majority | Adult maintains control until withdrawals | Controlled by adult | Controlled by trustee |

| Setup Complexity & Cost | Low to moderate | Low to moderate | Very low | High (legal fees involved) |

As the table illustrates, custodial accounts excel in investment flexibility and potential for wealth accumulation. Unlike 529 plans, custodial funds are not restricted to education, which offers freedom but requires discipline to ensure funds are used appropriately. On the other hand, savings accounts offer liquidity and safety but lack growth potential. Trusts provide highly customizable options but come with complexity and costs, often exceeding what many families need for straightforward gifting purposes.

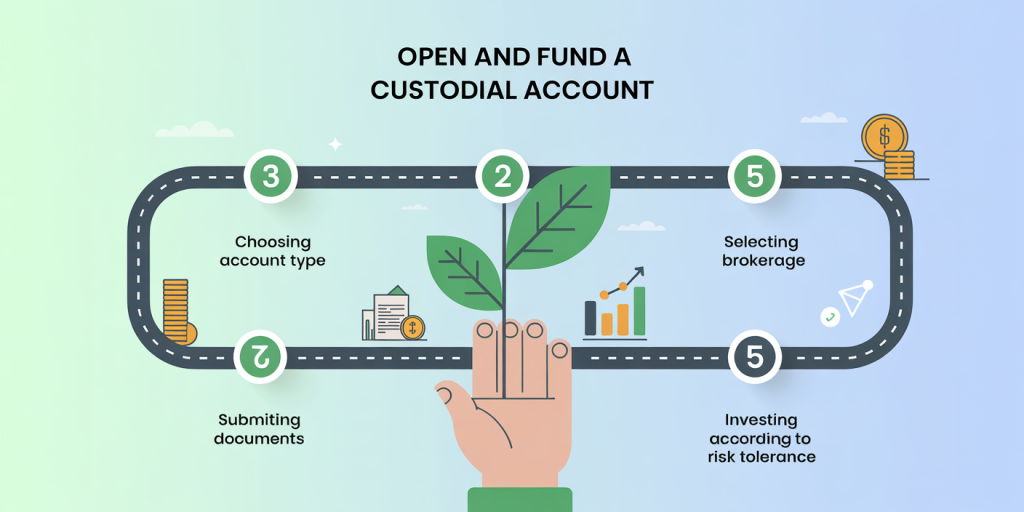

Practical Steps to Open and Fund a Custodial Account

Starting a custodial account is straightforward, but requires careful consideration to ensure compliance and informed investment choices. Here’s a practical step-by-step blueprint:

Step 1: Choose the Custodial Account Type

Decide between a UTMA or UGMA account depending on your state’s laws and your preferences. The main difference: UTMA can include a broader range of assets (including real estate), while UGMA typically restricts gifts to financial instruments.

Step 2: Select a Financial Institution

Most major brokerages such as Fidelity, Charles Schwab, and Vanguard offer custodial accounts. Compare fees, investment options, and online resources. Fidelity, for example, charges no account maintenance fees and provides access to thousands of commission-free ETFs, which is advantageous for long-term growth.

Step 3: Gather Required Documentation

You will need your personal identification, the child’s Social Security Number, and sometimes proof of guardianship. Remember, the custodian is responsible for managing the account prudently until the minor gains control.

Step 4: Fund the Account

Make an initial deposit. Custodial accounts accept gifts of cash, securities, and other assets. Be mindful of gift tax limits; in 2024, individuals can gift up to $17,000 per year per recipient without triggering gift tax filings. Parents can also make recurring contributions to grow the account systematically.

Step 5: Invest According to Goals and Risk Tolerance

Consider age-appropriate investment strategies. For example, a common approach is aggressive growth-oriented funds or diversified ETFs during early childhood, gradually shifting to more conservative bonds or dividend-paying stocks as the child approaches majority age. Real-life case studies demonstrate this strategy: the “Roosevelt Family Fund,” for instance, initiated investments in a broad-market S&P 500 ETF when their daughter was born and gradually adopted bond-heavy portfolios by her 18th birthday, achieving over 7% average annual returns.

Tax Implications and Reporting for Custodial Accounts

Understanding the tax landscape of custodial accounts is critical to optimizing returns and avoiding surprises during tax season. Annual earnings—both dividends and capital gains—generated by the account are taxed at the child’s income tax rate, which is often lower than the custodian’s. The IRS applies the “kiddie tax” to unearned income over a threshold ($2,500 in 2024) where amounts above are taxed at the parent’s marginal rate to avoid tax avoidance.

It is essential to file IRS Form 8615 if the child’s unearned income exceeds this limit. However, many custodial investment accounts provide annual tax documents (such as 1099-DIV for dividends) to assist with filing. Proper record-keeping and early consultation with a tax professional can ensure compliant and efficient tax reporting.

A survey performed by the CFP Board in 2022 indicated that 65% of parents who use custodial accounts found tax planning easier when using automated brokerage platforms with integrated tax reporting.

Teaching Financial Literacy Through Custodial Accounts

Beyond wealth accumulation, custodial accounts serve as powerful educational tools. Since the child legally owns the account assets once reaching the age of majority, they often develop a real, vested interest in financial understanding.

Parents can use the account as a platform to teach core concepts: stock market mechanics, the value of compound interest, risk management, and diversification. For example, engaging kids in periodic reviews of investment performance and decision-making can foster financial maturity. Real-life anecdotal evidence exists: The Johnson family involved their son in quarterly portfolio reviews starting at age 14, leading him to start his own Roth IRA at 18, evidencing the positive influence of early financial education.

Moreover, custodial accounts encourage conversations about saving for major life goals like college, buying a first car, or even future entrepreneurship.

Future Perspectives: Trends and Innovations in Custodial Investing

Looking ahead, custodial accounts are poised to evolve in response to technological innovation, regulatory changes, and shifting parental priorities. Digital-first investment platforms are simplifying account setup and management through intuitive mobile apps, automated portfolio rebalancing (robo-advisors), and educational content tailored for young investors.

Additionally, some fintech startups are integrating custodial accounts with allowance tracking, chore rewards, and gamified financial lessons, making money management engaging for children. For instance, Greenlight and Step offer custodial accounts embedded with debit and payment cards to provide real-world spending experiences under parental oversight.

Regulatory environments may also see reforms to increase contribution limits or adjust tax rules for minors, responding to growing awareness of wealth inequality and the importance of early financial empowerment.

From an investment standpoint, ESG (environmental, social, and governance) funds and socially responsible investing options are gaining traction among younger generations, including those investing on behalf of children. This trend signals a future where custodial accounts might not only grow money but also reflect family values and ethical priorities.

In summary, custodial accounts remain a versatile, powerful tool for building a child’s financial foundation. By leveraging the right strategy, sound tax planning, and educational practices, families can unlock meaningful financial security for the next generation. Whether you aim to fund college, jump-start a career, or instill lifelong money skills, custodial investing offers a practical, accessible solution ready for the future.